Inflation is forcing many Americans to borrow just to get by, turning credit cards and loans into lifelines instead of financial tools. Zety’s new Survival Debt Report reveals the extent of this growing crisis with alarming credit card debt statistics, which career expert Jasmine Escalera refers to as “survival debt.”

The survey of 1,005 U.S. employees found that more than half (56%) say their salary isn’t enough to both manage debt and contribute to future savings, while 48% have relied on debt in the past year to pay for essentials like groceries and utilities.

These financial pressures are forcing employees to make difficult trade-offs, from delaying retirement savings to cutting back on medical care, travel, and even family planning.

Key findings:

- Credit card debt dominates: 71% of workers carry credit card balances, making it the most common form of debt.

- Debt payments are a struggle: 1 in 5 (21%) can make only minimum payments on their debt, and another 9% often can’t even meet minimum payments.

- Survival debt keeps workers from saving: 56% say their salary isn’t enough for both managing debt and saving for the future.

- Inflation is fueling borrowing: 48% have relied on borrowing in the past year for essentials like food and utilities.

- Sacrifices are widespread: 70% have had to cut back on major life expenses, including travel (44%), retirement savings (22%), and even medical care (10%).

How Workers Are Managing (or Not Managing) Their Debt

For many Americans, debt management is a balancing act that often leans toward survival rather than strategy. While some are making efforts to stay ahead, others are barely keeping up or falling behind.

Only 27% aggressively pay off their debt to get rid of it quickly. Forty-three percent of respondents said they pay more than the minimum balance when possible, and 21% admit to making only minimum payments. Another 9% say they struggle to even meet those minimums and often get hit with interest charges.

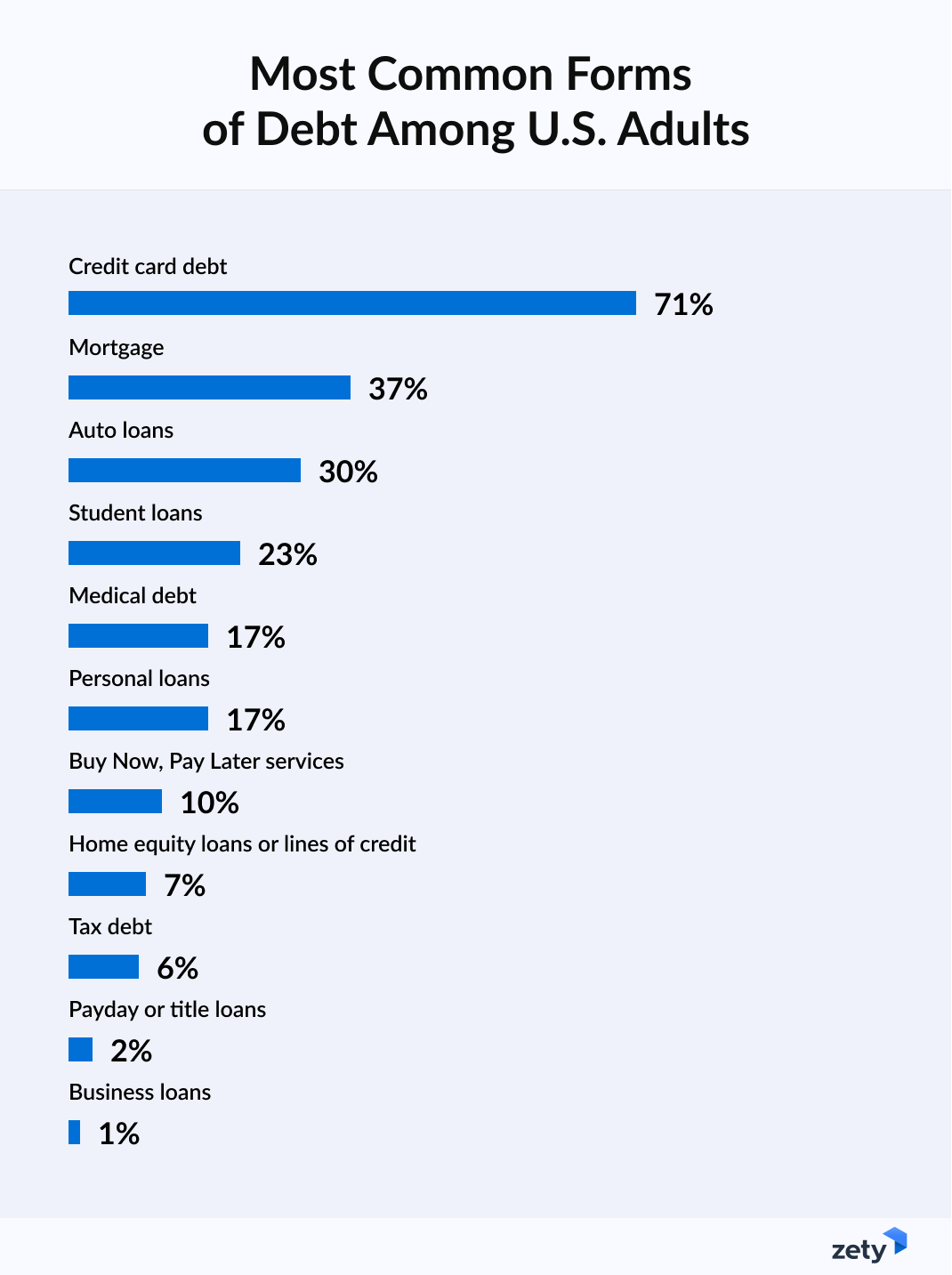

The types of debt people carry are equally diverse, with credit cards leading the list:

- 71%: Hold credit card debt

- 37%: Have mortgages

- 30%: carry auto loans

- 23%: Are paying off student loans

- 17%: Have medical debt

- 17%: Have personal loans

- 10%: Owe through Buy Now, Pay Later services

- 7%: Have home equity loans or lines of credit

- 6%: Have tax debt

- 2%: Use payday or title loans

- 1%: Carry business loans

What this means: Without structural changes to wages or financial support, individual strategies alone aren’t enough to break the cycle of mounting debt.

Inflation Pressures Push Borrowing

Instead of building savings or reducing balances, workers are leaning on credit to cover basic needs amidst inflation.

- 56% say their salary isn’t enough to both manage debt and save for the future.

- Due to inflation, 48% have relied on debt to cover essential expenses (e.g., groceries and utilities) in the past year.

What this means: The reliance on debt signals a widening gap between income and the real cost of living, leaving workers perpetually vulnerable to economic shocks.

Debt-Driven Lifestyle Trade-Offs

Americans are making significant sacrifices to stay afloat financially. Among those surveyed:

- 44%: Have postponed or skipped travel or vacations

- 41%: Have cut back on entertainment or dining out

- 36%: Have given up hobbies or personal interests

- 24%: Put off buying or upgrading a car

- 22%: Delayed saving for retirement

- 16%: Have given up buying a home

- 10%: Even skipped necessary medical care or prescriptions

- 8%: Delayed having children or growing their families

Only 30% said they haven’t had to give up anything to manage their debt.

What this means: Debt-driven choices are increasingly unavoidable, forcing employees to balance short-term survival with long-term stability in ways that limit opportunities and peace of mind.

The pressure to make ends meet is forcing workers to adapt in ways that reach beyond their wallets. Decisions about health, family, and long-term plans are increasingly influenced by the need to stretch resources, leaving many feeling trapped in a cycle of ongoing compromise.

For press inquiries, contact Skyler Acevedo, Public Relations Specialist, at skyler.acevedo@bold.com.

Methodology

The findings presented are based on a nationally representative survey conducted by Zety using Pollfish on June 12, 2025. The survey collected responses from 1,005 U.S. workers, examining their personal debt, financial behaviors, and related lifestyle and career impacts. Respondents answered different types of questions, including yes/no, scale-based questions where they indicated their level of agreement with statements, and multiple-choice where they could select from a list of provided options. The sample consisted of 52% female and 48% male respondents, with 19% Gen Z, 29% Millennials, 28% Gen X, and 24% Baby Boomers.

About Zety

Zety resume templates and Zety's Resume and Cover Letter Generator are trusted by 12 million users each year. With 100s of options to choose from, including professionally designed resume templates to beat the ATS, users can create a professional resume in less than 15 minutes. Since 2016, Zety’s career blog has provided free data-driven insights to over 40 million readers annually, empowering professionals at every stage. The editorial team includes Certified Professional Resume Writers, with the best career advice and evidence-based findings featured in Business Insider, CNBC, and Forbes, among others. Follow Zety on Facebook, LinkedIn, YouTube, X, and Instagram for free expert career tips and updates.