What frightens you? What keeps you up at night in a state of fear and anxiety?

There’s fear of snakes, spiders, and public speaking. Some people even suffer a fear of clowns.

But for many, there’s another fear. One that you might not expect, and a situation that almost all of us will have to face one day.

Retirement.

Turns out the shine is wearing off the golden years before they’ve even begun. And many people fear retirement more than death itself.

We surveyed 800+ Americans to find out more about their feelings on retirement and see what preparations they’re making for it. Here’s what we discovered:

- How fear of retirement compares to fear of death or illness

- What aspects of retirement scare people

- Opinions about claiming Social Security retirement benefits

- What other types of pension and investments people plan to rely on

- What worries people about retirement in their own words

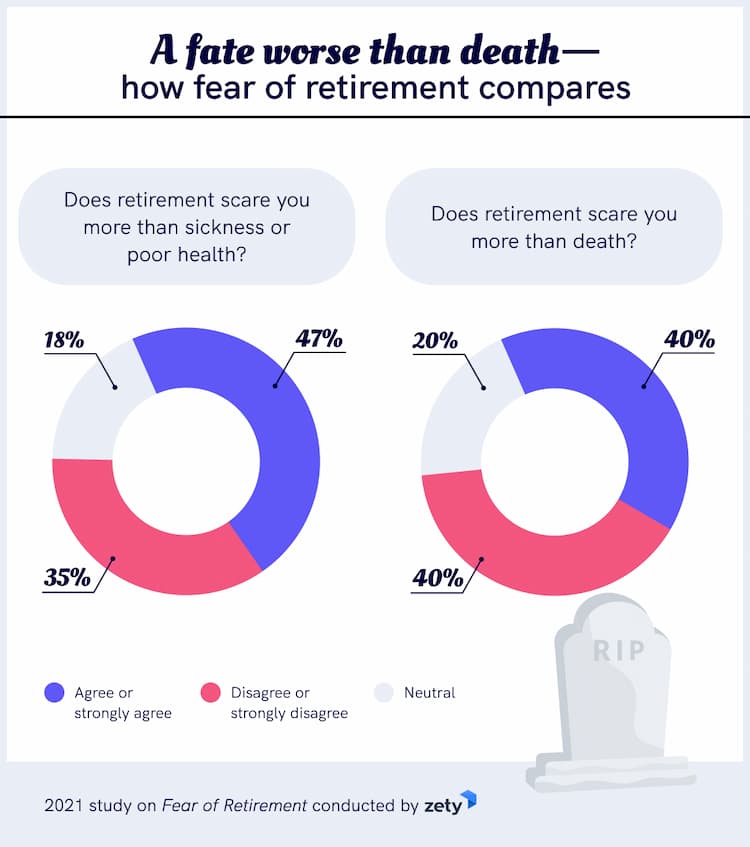

A fate worse than death—how fear of retirement compares

Not everyone fears retirement but for those that do, it can be a terrifying prospect indeed. For many, it’s even more frightening than death or illness.

Overall, 40% of our respondents who feared retirement agreed that it scared them more than death itself. But when we ran the numbers based on demographics, things got even more interesting.

Then when we compared retirement to sickness or poor health the figures were even more striking. Overall, 47% of respondents feared retirement more than poor health.

Initially, this generational split felt counterintuitive. Younger people are further from retirement, it doesn’t loom as large as it does for older workers. But in reality it’s actually a good fit with the broader fears for the future that younger people hold.

Worldwide, it’s well-documented that wages have stagnated in recent decades and that youth unemployment remains stubbornly high. So for younger people already facing economic uncertainty, it’s no wonder that they have magnified fears about retirement.

And though retirement is a significant fear for them, many younger people don’t even think it’ll happen. They’re actually just as scared of not retiring at all.

We asked our respondents if they think they’ll actually be able to retire, or they believe they’ll have to keep working. Overall, it was almost a perfectly even 50/50 split, but when we made a comparison based on age the results were telling.

Of those aged 55 and older, fully 62% were confident they’d be able to retire, but that dropped to 45% for the younger cohort aged younger than 39.

So it’s fair to say that retirement, or not even being able to retire is a genuine concern. But just what is it that makes it such a terrifying prospect?

To find out we dug even deeper into people’s fears about their golden years.

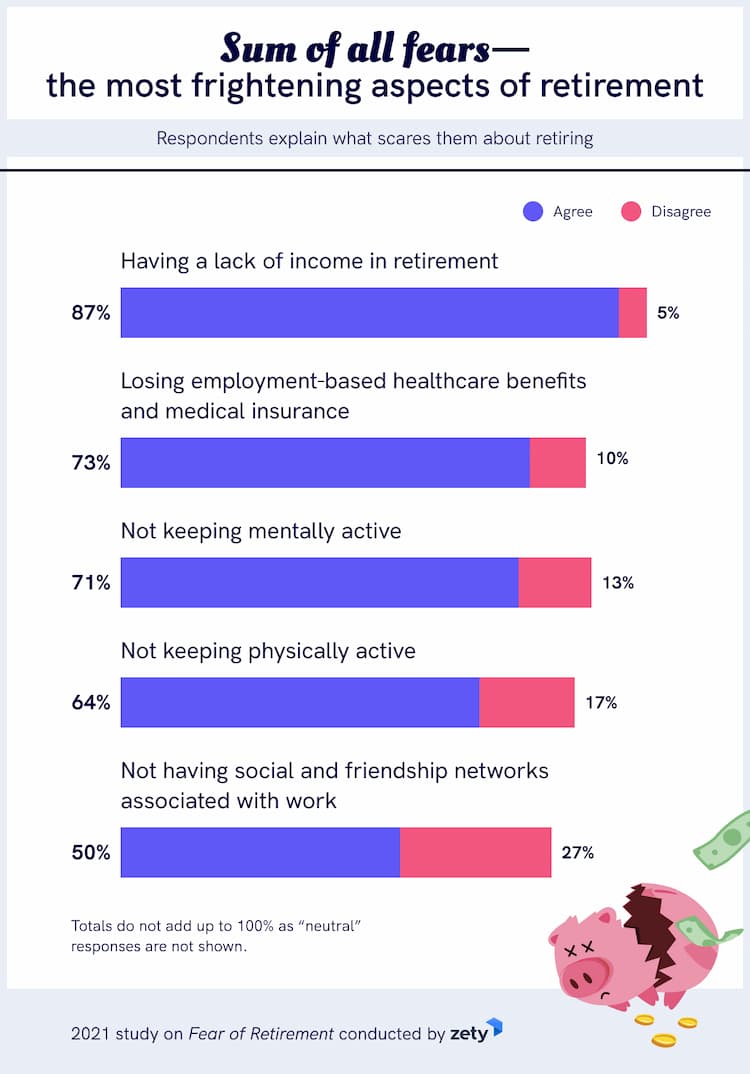

Sum of all fears—the most frightening aspects of retirement

Obviously losing income and losing medical insurance are huge concerns. And they’re closely connected. After all, we're more likely to need medical care as we age, and covering medical costs on a reduced income isn’t exactly easy.

But the fear of slowing down in retirement is a big concern too. 71% reported they were worried about being less mentally active in retirement, and 64% about being less physically active.

Contrast this with the prospect of losing social and friendship ties from work where 50% of respondents found it a frightening prospect.

Perhaps though this is one aspect people should take more seriously. There’s a proven correlation between having strong social ties and having a reduced mortality risk.

But on the other hand, if retirement itself is more frightening than death then reduced mortality probably isn’t your biggest concern.

So we’ve seen there’s plenty of anxiety out there about retirement. And it’s well-established that there’s a close link between uncertainty and anxiety.

This made us wonder whether uncertainty about retirement planning is linked to fear of retirement. Do people know what faces them, and have they put firm plans in place for a retirement income?

That’s what we explored next.

A matter of Social Security

Social Security for senior citizens traces its origins back to the Great Depression of the 1930s, where poverty rates amongst older Americans exceeded 50%. Since then, it has become an important lifeline for them.

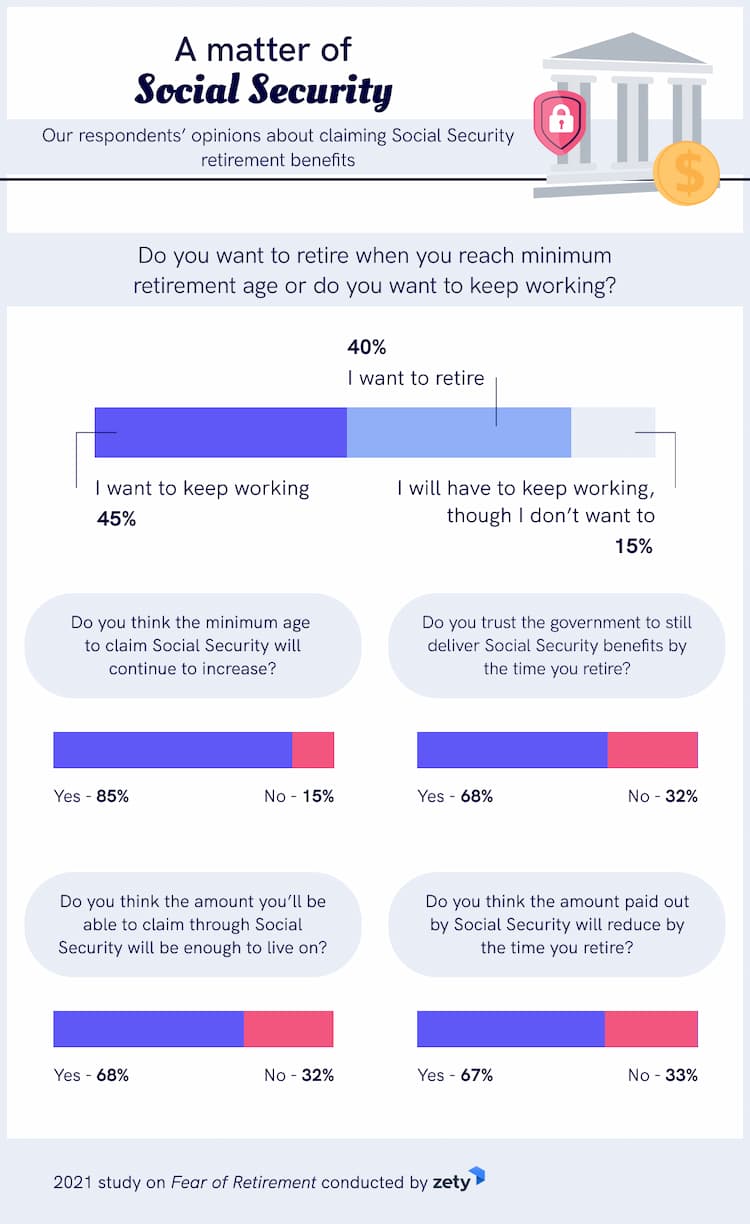

Here’s a breakdown of our respondents’ opinions about the Social Security retirement benefits system:

First we looked at attitudes about minimum retirement age. That’s currently set at 62, but you’ll receive a reduced rate compared to waiting for full retirement age. That’s currently 67 years old for anyone born in 1960 and later.

It seems plenty of folks want to stay on the job, almost half of our respondents, 45%, said they’d like to keep working after reaching the minimum retirement age. And there was a roughly equal amount, 40%, who said they’d like to retire.

Spare a thought though for the unfortunate 15% who said they’d like to retire but will be forced to keep working.

There was also a healthy dose of skepticism about the future of Social Security. Most people, 68%, still trust the government will deliver them retirement benefits. But, the majority also believe that those benefits won’t be as generous by the time they retire.

Here’s a breakdown:

- 85% think the minimum age for claiming Social Security will continue to increase.

- 67% think the amount paid out by Social Security will reduce by the time they retire.

But—

- 68% still think the amount they’ll be paid will be enough to live on.

So just how much do people think they’ll receive?

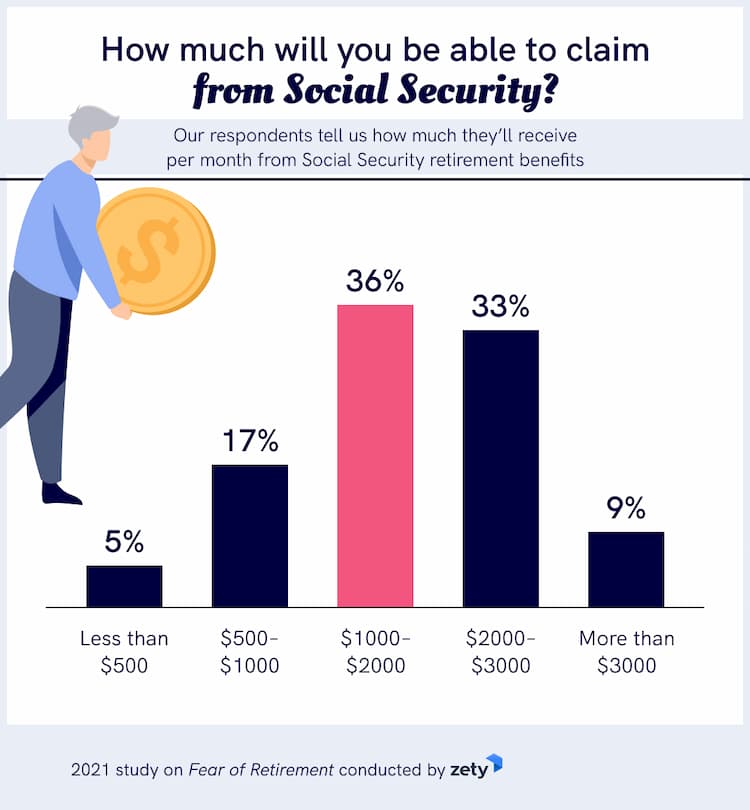

Worryingly, 40% of people said they didn’t know how much they’d receive from Social Security. That’s exactly the sort of uncertainty we believe is contributing to fears about retirement.

The figures in the infographic above came from those who did know, and they fit pretty well with data from the Social Security Administration.

The SSA says that in 2021 the average monthly benefit is $1,544 and our biggest group of answers was in the $1000–$2000 per month range.

As for those lucky few claiming over $3000? The current maximum amount you can claim is $3,895, and you’ll get that if you work for 35 years, wait until 70 to retire and earn an average of $142,000+ annually.

But is Social Security alone enough? A rough rule of thumb given by experts is that you need to receive 80% of your pre-retirement income to maintain your lifestyle.

So a person who earned $142,000 pre-retirement would need to receive roughly $9,500 a month. As you can see, even the maximum amount of social security they can claim just won’t cut it.

Let’s look at this from another angle:

- Average weekly earnings are currently $989 a week.

- That converts to around $4,290 a month.

- Using the 80% rule the average salary earner would need to claim retirement benefits of around $3,400 per month.

- Yet less than 10% of our respondents say they’ll claim $3,000+ per month.

Clearly there’s a massive shortfall. So what other arrangements are people making to cover it?

Making other arrangements—pensions and savings

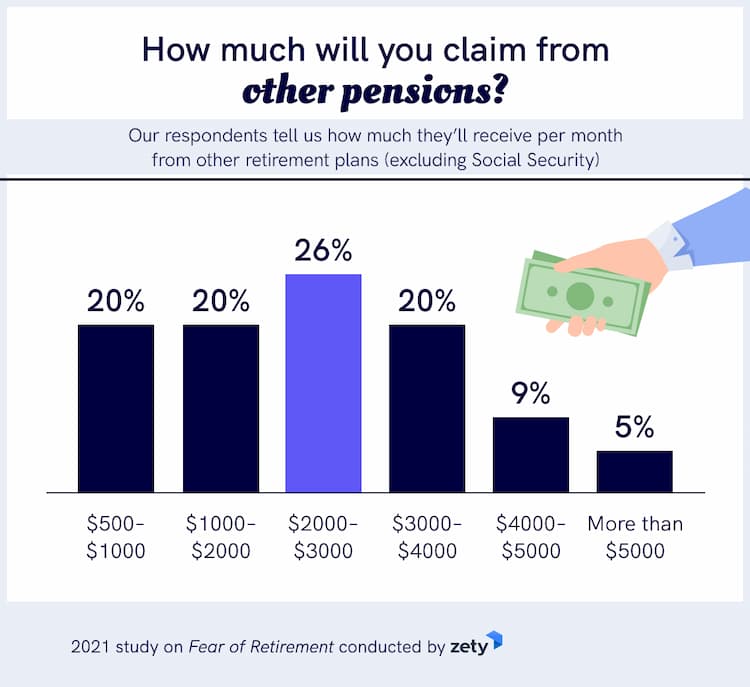

Overall, 47% of our respondents had access to pensions other than Social Security. But that generational split came into play again. Only 39% of those aged younger than 39 had alternative arrangements compared to 51% of those aged 55 and older.

Again, there was still a significant percentage of people who had no idea what they could stand to receive from their other pensions, 32%. But for those who did know, here’s what they reported as their estimated monthly earnings.

Now let’s compare that with what people consider to be a sufficient monthly income for a comfortable retirement.

As you can see, at the lower end of the scale there’s a real disconnect. People recognize that a lower income in retirement just won’t cut it. Just 22% of respondents thought that a retirement income of less than $2000 a month was sufficient.

Yet that amount is what 40% of people with other pensions will claim, and what 58% of those who’ll claim Social Security will earn in retirement benefits.

Remember, not everyone has access to both income streams. And even those that do could end up struggling.

And that actually fits in well with our own findings. As we’ve just said, 53% of our respondents have no access to other pensions, and even more worryingly, 25% said they won’t claim Social Security.

When you put all the numbers together it’s genuinely concerning, and doesn’t bode well for the future of many older Americans.

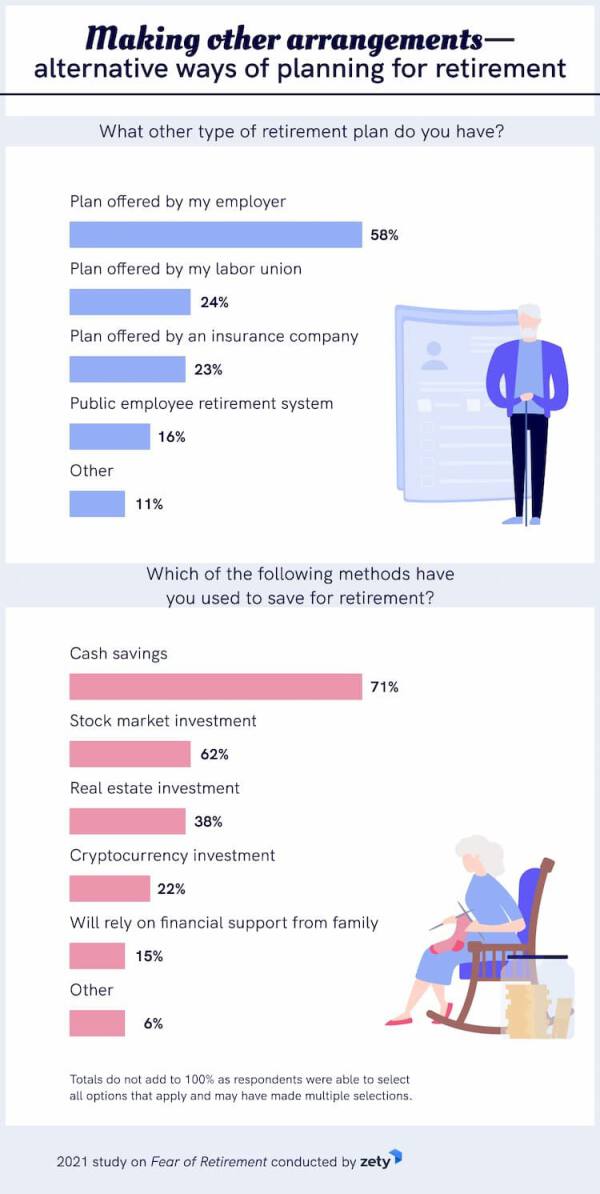

There was a glimmer of hope though. It seems that people are trying to make alternative arrangements for retirement.

The first set of numbers you’ve just seen reflect the most popular types of alternative pension utilized by those people who have access to them.

And of people who do have financial arrangements for retirement, of any type, 82% have other sources of saving and income to rely on.

What was particularly interesting was the methods they’re relying on to save for retirement.

Good old cash savings came out on top with 71% saying they’re using this method.

But with current interest rates for cash savings running at less than 1% those savings won’t exactly grow much.

But a majority also said they had made stock market investments, 62%, and with an annualized return of around 10% over the last 30 years, that’s a pretty good saving method.

So yes, Warren Buffett is right. And no, we’re not related, I wish!

38% said they had real estate investments, clearly taking Will Rogers’ timeless advice: “Don’t wait to buy land, buy land and wait,” to heart.

And to round things off, a very trusting 15% of people said they’d rely on financial support from their family. But of course there are all sorts of caveats on relying on others too.

So we’ve just bombarded you with numbers, but we wanted to put a more personal face on people’s fears about retirement too.

A penny for your retirement thoughts—real people respond

We gave our respondents the opportunity to tell us in their own words what worries them about retirement. Here’s a selection of their thoughts.

“I will be bored. My work is basically my life. I do not know what I will do in my free time.”

“I feel I won’t be able to pay my bills or do the things I want and just feel like I’m waiting to die.”

“I am less than fifteen years away from retirement age and I know now already that what I get from social security will not cover my needs nor do I have a pension of any type. I will probably work until I die (health permitting).”

“My generation doesn't have the guaranteed pensions and other employee-sponsored retirement income that previous generations had, and I will have to rely upon social security to help make ends meet. That scares me because I don't come from a family with trust funds and inheritances.”

Conclusion

Fear of retirement is real. For many people it trumps even the fear of death or illness. And like other fears and anxieties, much of it is driven by uncertainty.

Our research has revealed that far too many people don’t know how much they’ll be able to receive in retirement. Others have no arrangements at all in place.

Here’s a reminder of our key findings:

- When people are frightened of retirement it’s a fear worse than death for 40% and worse than poor health for 47%.

- Younger people are more frightened of retirement than their elders.

- 25% of people say they won’t claim Social Security. 53% have no access to other pension plans and 20% say they have nothing at all for retirement.

- According to their current financial arrangements, most people will struggle to maintain their standard of living in retirement.

There’s a ticking time bomb of future struggling seniors waiting. And their numbers are set to explode too. There were 54 million Americans aged 65 and older in the 2019 census. By 2040 that’ll hit 80 million.

But we can mitigate the worst effects if we take action.

Our advice is to confront your fears and start making plans for retirement, even if you’re skeptical about being able to stop working. There is plenty of help available for all sorts of circumstances.

A quick Google search on retirement planning will reveal a wealth of information. And if you’re having trouble cutting through the noise, take a look at the link below to a useful leaflet produced by the Department of Labor.

Retirement can be frightening, there’s no shame in feeling daunted by it. But it’s not just going to go away if you ignore it. Start taking steps, however small, to get your golden years in order.

And as promised, here’s the link to the DOL’s very useful Top Ten Ways to Prepare for Retirement.

Methodology

The findings presented were obtained by surveying 877 American respondents. They were asked questions relating to their fears about retirement and the financial arrangements they were making. These included yes/no questions, scale-based questions relating to levels of agreement with a statement, questions that permitted the selection of multiple options from a list of potential answers, and a question that permitted open responses.

Sources

- Bureau of Labor Statistics, “Usual Weekly Earnings of Wage and Salary Workers First Quarter 2021”

- Hagen, K., “How Much Do I Need to Retire Comfortably?”

- Maverick J.B., “What Is the Average Annual Return for the S&P 500?”

- Munnell A., Chen A., and Siliciano R., “The National Retirement Risk Index: An Update From the 2019 SCF.”

- Social Security Administration, “Retirement Benefits—Starting Your Retirement Benefits Early”

- Social Security Administration, “Social Security Basic Facts”

- Social Security Administration, “Workers With Maximum-Taxable Earnings”

- Urban Institute, “The US Population is Aging”

- Weaver C., Support of the Elderly Before the Depression: Individual and Collective Arrangements

Fair Use Statement

Want to share our content to help people face their fears about retirement? We’d love you to. All we ask is that you link back to this page, giving full credit to our authors.

About Us

Zety is there to help you on your career path, no matter what stage you’re on. Explore our collection of best resume templates, see resume examples for jobs in most industries, including jobs for seniors, find a perfect cover letter template, and more.

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.