Citigroup, one of the world's largest financial services companies, recently announced a restructuring plan involving the elimination of approximately 20,000 jobs globally, according to reports from Bloomberg. This cut is part of the company’s broader strategy to streamline operations and focus on areas of high growth.

In this article, I’ll explore the reasons behind Citi’s layoffs and their impact on employees. For those affected, I provide practical steps to manage the transition, from gathering essential documents to crafting a strong job application. Additionally, I’ll share tips and ideas on how to turn this challenging period into an opportunity for career growth.

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

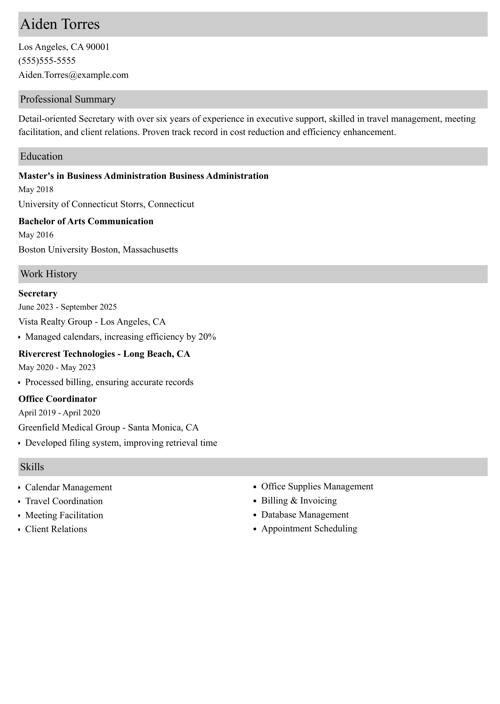

Sample resume made with our builder—See more resume examples here.

One of our users, Brittanya, had this to say:

Zety really helped me create the best resume possible. It pointed out how things could be better on my existing resume and suggested many things to be re-worded or removed.

Citi Layoffs in Numbers & Affected Departments

Citigroup, a global leader in financial services, is undergoing substantial restructuring to optimize its operations and adapt to changing market demands. The company recently unveiled plans to cut approximately 20,000 jobs globally, representing about 10% of its total workforce. These layoffs are expected to impact various regions, with a notable concentration in the U.S. and Europe.

This move is part of CEO Jane Fraser’s efforts to simplify the bank’s structure and improve financial performance. According to CBS News, the layoffs are expected to bring Citigroup's headcount down to around 180,000 by 2026.

The primary areas affected by these job cuts include:

- Investment banking: Positions such as analysts, associates, and junior-level bankers are being eliminated as Citi reduces activity in less profitable sectors and regions.

- Retail banking: Staff reductions, including tellers and branch managers, stem from the closure of physical branches and the growing reliance on digital banking services.

- Technology and operations: Roles in IT support and back-office operations are being phased out due to the implementation of advanced automation and cloud technologies.

- Risk management and compliance: Job cuts in these departments are driven by the increased use of AI-based monitoring systems and streamlined regulatory processes.

Citi is shifting toward a more technology-focused and streamlined organizational model. To support displaced employees, the bank is providing severance packages and assistance with career transitions, which I will cover further.

Key Reasons Behind Citibank Layoffs 2024 & 2025

Citi’s decision to reduce its workforce is influenced by various factors. First, the increasing reliance on digital technologies has reduced the need for manual processes, leading to a decline in traditional roles. Additionally, shifts in consumer behavior, such as the growing preference for online banking and mobile services, have significantly diminished the demand for in-person services at physical company locations.

These changes, coupled with rising costs and global economic uncertainties, have intensified the need for operational efficiency. By focusing on high-growth areas such as wealth management, institutional banking, and fintech, Citi aims to realign resources and sustain long-term profitability.

These restructuring efforts reflect broader industry trends. For instance, JPMorgan Chase

recently cut 1,000 jobs as part of its own efficiency measures, while Bank of America has been consolidating roles in response to increased automation. Such initiatives are the result of the financial sector’s shift toward streamlined operations and technology-driven solutions, with a focus on maintaining competitiveness in an expanding market.

How Citi Supports Employees During Layoffs 2024 & 2025

Despite the challenges of job cuts, Citi offers support to affected employees through severance packages and transition assistance. Specific details may vary depending on factors such as role, tenure, and location. Key components of Citi’s severance packages typically include:

- Financial compensation: Lump-sum payments or salary continuations based on years of service. For instance, the basic severance benefit available to eligible employees is two weeks of base pay for each full 12 months of service, up to a maximum of 52 weeks of base pay.

- Benefits: Temporary extension of healthcare and other benefits. In some cases, employees may have the option to extend benefits further through COBRA coverage.

- Outplacement services: This includes one-on-one career coaching, resume reviews, and access to job boards. For instance, affected employees may be offered up to six months of outplacement services to aid in their job search.

- Skill development programs: Access to training and certification courses to enhance employability. Employees may be provided with stipends or free enrollment in programs such as project management, data analysis, or financial planning certifications to enhance their career prospects.

If you’re an affected employee, consult Citi’s HR resources for the most up-to-date information and personalized guidance on available support options.

What Documents Do You Need for Your Job Search

Preparing for a job search starts with gathering the right documents. These include:

- Employment records: Clear documentation of job titles, dates of employment, and key responsibilities. For example, providing detailed descriptions of your roles and contributions at Citi can help illustrate your career progression and areas of expertise.

- Performance reviews: Feedback from supervisors highlighting your strengths, professional achievements, and areas of growth. Including samples of positive performance, evaluations can demonstrate your ability to meet and exceed expectations.

- Certifications: Industry-relevant credentials, such as CFA (Chartered Financial Analyst) for financial roles or AWS (Amazon Web Services) certifications for technology positions. These certifications validate your expertise and commitment to professional development.

- Achievements: Quantifiable accomplishments, such as leading a project that increased revenue by 15% or implementing a system that reduced operational costs by 20%. Including specific metrics adds credibility and impact to your applications.

- Awards and recognitions: Proof of exceptional contributions, such as Employee of the Month awards or recognition for successful project completions. These accolades can set you apart from other candidates.

Pro tip: Organize these documents in a digital portfolio or accessible format to streamline the application process and ensure you’re prepared for interviews.

How to Prepare a Strong Job Application After Citibank Layoffs

In today’s competitive job market, especially after a layoff, it’s more important than ever to craft a resume and cover letter that captivate employers. These documents give you a chance to turn challenges into opportunities, highlight your strengths, and make a strong impression as the right candidate.

Here are some key tips to help you write a strong resume:

- Tailor your resume to each specific role, emphasizing relevant skills and achievements. For instance, if applying for a financial analyst role, highlight experience in data analysis, forecasting, and financial modeling.

- Use measurable results to demonstrate your impact, such as “Increased client retention by 20% through personalized service strategies” or “Streamlined reporting processes, reducing preparation time by 30%.”

- Focus on transferable skills like leadership abilities, project management, and problem-solving that are valuable across industries.

- Ensure your resume is clean and professional in format, making it easy to read and visually appealing.

- Include relevant certifications or training, such as a CPA license, Six Sigma certification, or proficiency in financial software like Bloomberg or SAP.

Then, create a perfect cover letter to complement your resume, providing additional context and expressing enthusiasm for the role. Address the layoff professionally and focus on your future goals. Here’s an example that shows how to do it:

As part of Citigroup's restructuring, my position was impacted. However, this experience has reinforced my commitment to driving innovation and achieving outstanding results in [specific field].

Highlight how your skills and experiences align with the company’s goals and values. Mention specific projects or initiatives that resonate with you to show genuine interest. End with a confident call to action, such as: “I welcome the opportunity to further discuss how my skills and experience can contribute to your team’s success.”

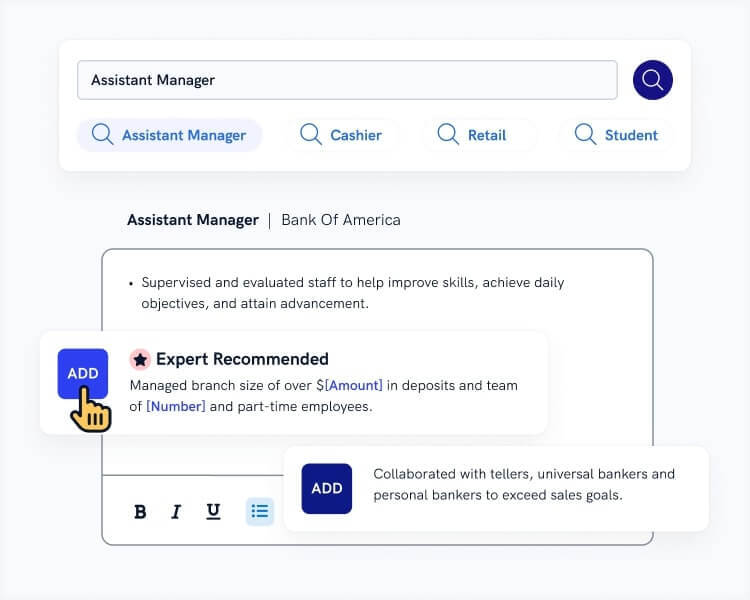

Creating a resume with our builder is incredibly simple. Follow our step-by-step guide and use content from Certified Professional Resume Writers to have a resume ready in minutes.

When you’re done, Zety’s resume builder will score your resume and our resume checker will tell you exactly how to make it better.

How to Maximize Your Job Prospects After Citi Layoffs

Losing a job, such as the recent layoffs at Citibank, can be both challenging and transformative. While it may feel like a setback, it also gives an opportunity to shift toward roles that promise greater growth and success.

Consider the following activities to increase your chances of securing an excellent new position:

- Networking: Connect with former colleagues, industry professionals, and alumni groups to explore potential job openings and gain insights into emerging opportunities. Attending industry events or reaching out through platforms like LinkedIn can help you build valuable connections.

- Optimize your LinkedIn profile: Ensure your profile is up-to-date, highlighting your key accomplishments and skills. Share relevant content, participate in discussions, and seek endorsements from colleagues to boost your visibility to recruiters.

- Join professional groups: Become an active member of industry associations or LinkedIn groups. Engaging in discussions and sharing insights can position you as a knowledgeable professional and help you connect with others in your field.

- Explore job boards: Utilize platforms like Indeed, Glassdoor, and eFinancialCareers to search for roles tailored to your expertise. Setting up alerts for specific job titles or industries can help you stay informed about new opportunities.

- Upskill: Take advantage of online courses, webinars, or certification programs to enhance your qualifications. Focus on high-demand areas like fintech, data analytics, or sustainable finance to broaden your career prospects and stay competitive in the evolving job market.

Pro tip: Stay proactive by following up on applications, engaging with recruiters, and participating in industry events. Being visible and persistent can significantly enhance your job search success.

Citi Layoffs in 2024 & 2025: Conclusion

Citi’s layoffs may be a tough challenge, but they can also be a turning point for new opportunities. The financial world is changing fast, with areas like fintech, green finance, and digital banking growing rapidly. As a former Citi employee, your skills and experience can open doors in these exciting fields, both within and beyond traditional banking.

Let’s outline essential steps to turn this challenging period into arising opportunities:

- Organize essential documents

Start by gathering employment records, performance reviews, certifications, and any awards or commendations. These documents validate your skills and achievements, strengthening your job applications. - Craft a standout job application

Tailor your resume to emphasize quantifiable achievements, such as increasing efficiency or improving processes. Pair it with a compelling cover letter that explains your layoff with professionalism and focuses on your future career aspirations. - Optimize your LinkedIn profile

Ensure your profile is current, with a professional photo, clear headline, and well-written summary showcasing your expertise. Highlight measurable successes, connect with industry professionals, and join relevant groups to expand your network. - Leverage networking and industry-specific job boards

Reconnect with former colleagues, alumni, and mentors. Use platforms like LinkedIn, TrueUp, and finance-focused job boards to uncover hidden opportunities and gain insights into emerging trends. - Upskill to stay competitive

Enhance your qualifications by attending workshops or earning certifications in high-demand areas like fintech, green finance, or data analytics. Continuous learning will give you an edge in a rapidly developing job market.

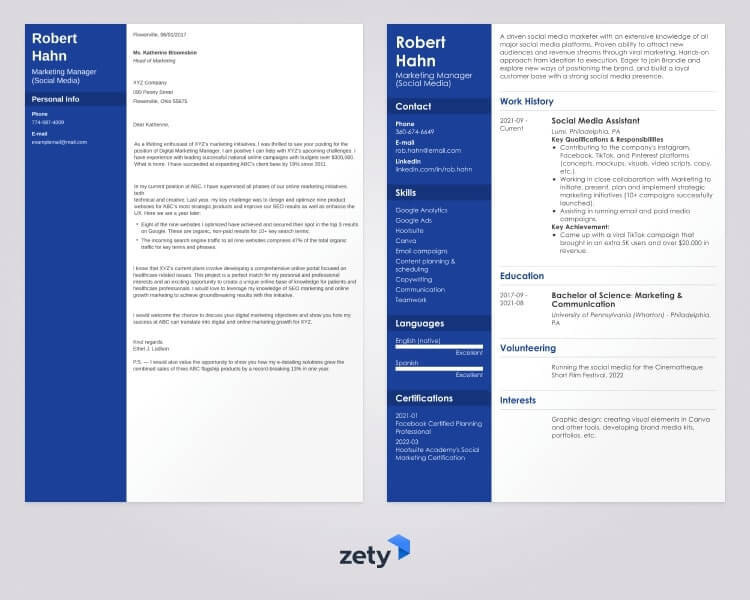

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

Thank you for reading this article on Citibank layoffs in 2024 and 2025. If you're one of the affected employees, I hope this guide helps make the transition process smoother for you.

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.