Everyone knows how stressful life as a financial advisor can get. The only thing that’s more stress-inducing? Finding a new financial advisor job.

We’ve all been there. Sending dozens of resumes, getting little to no response. Working with numbers is easier than working with people, right?

To land your dream job, your financial advisor resume should be as special as the Pi. The process is as simple as 1-2-3.

This guide will show you:

- A financial advisor resume example better than 9 out of 10 other resumes.

- How to write a financial advisor resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a financial advisor resume.

- How to describe your experience on a resume for a financial advisor to get any job you want

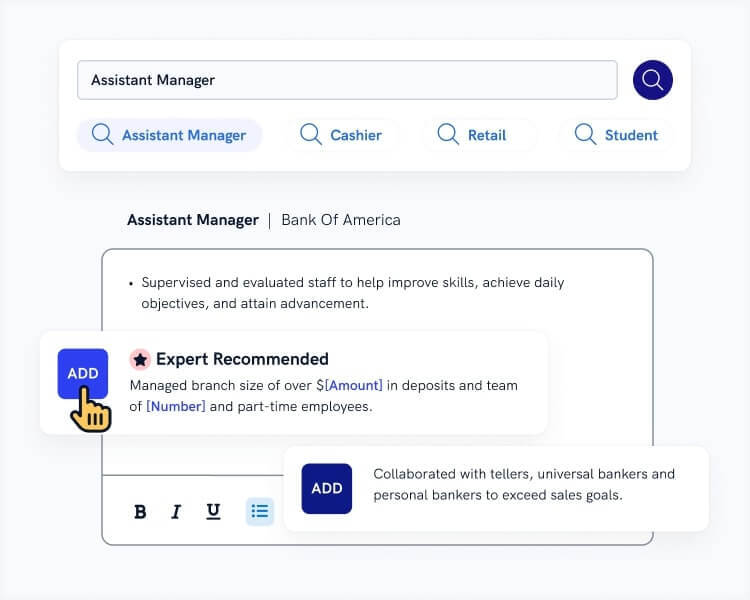

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

Sample Financial Advisor Resume—See more resume samples here.

Writing just a financial advisor resume or something more? See our other guides:

- Accounting Resume Sample

- Bank Teller Resume Sample

- Bookkeeper Resume Sample

- Business Analyst Resume Sample

- Budget Analyst Resume Sample

- Entry Level Business Analyst Resume Sample

- Financial Analyst Resume Sample

- Accounts Receivable Resume Sample

- Finance Resume Sample

- Entry-Level Resume Sample

- Resume Examples for Every Career

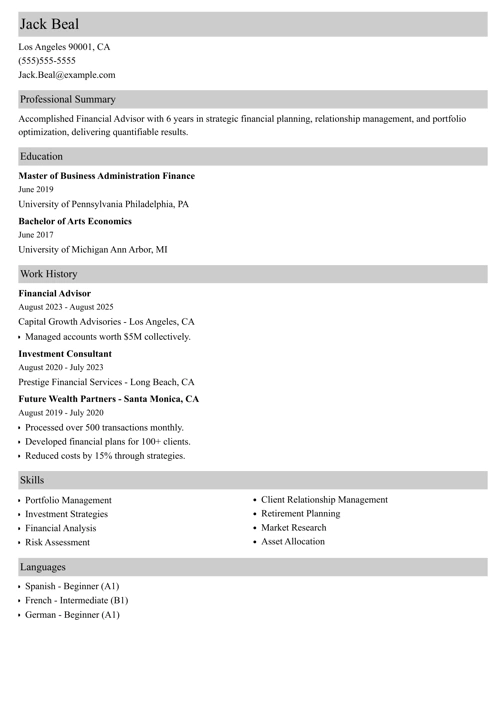

Sample Financial Advisor Resume Sample

Jack Beal

jack.q.beal@gmail.com

708-408-7131

LinkedIn.com/in/jack-q-beal

Twitter.com/jackqbeal

Professional Summary

High-performing financial advisor with 6+ years of experience. Highly skilled in client education, financial planning, and analysis. Seeking position at Resnick & Sheckley Financial Services. At Fairchild Livingston, raised client satisfaction score from 85% to 99% through using automation to free up more time to spend with clients. Maintained client returns 4% higher than team average.

Work Experience

Financial Advisor

Fairchild Livingston

Nov 2014–March 2019

- Executed trades, managed internal systems, and wrote financial plans for 150+ clients with over $200M under management.

- Maintained client returns 4% higher than team average.

- Increased client satisfaction scores from 85% to 99% through using time-saving automation tools to spend 8 hours more per week with clients.

- Increased AUM by 25% in 18 months.

- Used UAFRS data from Valens Research to identify undervalued investments. Raised individual investor client performance by 35%.

Financial Advisor

Melcher Advisors

Nov 2013–Nov 2014

- Developed and presented financial planning and investment seminars for clients and prospects. Increased client satisfaction 50% and grew client base 28%.

- Created standardized reports that resulted in a better understanding of real-time performance. This allowed the firm to raise client returns 15%.

- Mentored 3 financial advisors who had been marked for termination. They became 3 of the firm’s top 5 performers.

Education

2009–2013 Northwestern University

Bachelor of Science in Business

- President, MarketWatch student organization. Grew membership by 200%.

- Conducted senior project to build imaginary hedge fund. Based on stock picking, would have grown $50,000 into $100,000 in one year.

Skills

- Hard skills: Client education, generating reports, equity analysis, sales

- Soft skills: Interpersonal skills, communication, collaboration, analytical skills

Activities

Volunteer financial planner for Arthur Zissner Charitable Trust, $3.5M AUM.

Row in a competitive rowing shell 3x per week for fitness and self-care.

Here’s how to write a financial advisor resume that gets jobs:

1. Choose the Best Format for Your Financial Advisor Resume

A shoddy financial advisor resume makes you look shoddy.

For a financial advisor, that’s the death knell.

So use these template steps to get your ducks in a row:

- Pick a respected resume format. For financial advisor jobs, the chronological resume layout works best. It puts your latest & greatest front and center.

- Put a nice big resume heading at the top and populate it with your name and a pro job title (Financial Advisor).

- You need white space or your resume will look like a stock ticker. Use readable resume fonts to save the hiring manager from eye strain.

- Finally, do you need a Word or PDF file resume? PDFs are more stable—unless the job ad says “no PDFs.”

Pro Tip: How long should your resume be for financial advisor jobs? If you’ve got so many stunning moments you can’t fit them all in one page, use two or more.

2. Write a Financial Advisor Resume Objective or Resume Summary

You need them to notice you.

So, write a financial advisor resume job profile with a difference:

Fund it with your juiciest accomplishments.

Got 2+ years of financial advisor experience? Use a well-written resume summary. That’s a few sentences, a couple of skills and achievement-based proof.

Got less than 2 years of experience? Use an appealing resume objective. You’ll center on your skills, but still add a transferable “win” or two from another job.

For instance? If you had a sales job, show you raised sales 25%. That’s a skill that works in financial advisor jobs too.

Pro Tip: Don’t jump right into writing your financial skills resume profile with both feet. Write your other sections first. Then come back and summarize them in your profile.

3. Write a Valuable Financial Advisor Job Description for Your Resume

How can you prove you’re perfect for the job?

Well, what is a financial advisor?

It’s someone who advises, creates financial plans, and provides financial services to clients.

So—

Show you’ve done that. Not by saying, “I did XYZ” but by saying, “I raised X metric by Y%.”

That’s what your financial advisor resume work history section must do.

- Cite your last job at the top. Use a job title that’s professional (Financial Advisor).

- List the firm’s name and the dates you started/stopped.

- Include a few bullet points (3–5 is best).

- In those bullets, write a mix of duties and achievements. Remember, not just, “handled report generation,” but, “slashed reporting errors 55%.”

- Customize your resume accomplishments to the FP&A job you’re applying to.

- Use numbers. Dollars, percents, hours, and numbers of clients or trainees make the story real.

- Employ resume power or action words to get the employer’s pulse rate up.

Pro Tip: Put 5 bullets in your most recent job, then 4 in the next and 3 in the next. Taper off your bullets to put the focus on your newest financial advisor job.

4. Write a Strong Financial Advisor Resume Education Section

You know this:

A great resume for financial advisors needs a strong education section.

But—

You need to make it sell.

Prove your financial advisor skills with key educational achievements:

- List your school name, degree, and years attended.

- Want to show leadership? Talk about the student group you led.

- Need to show passion for investing? List a student portfolio project you completed.

- You can also talk up sports teams, academic honors, and even kudos from professors.

- Leave your GPA out of it unless it scorched the sky or you just graduated.

Financial advisor job statistics

- The employment of personal financial advisors in the US is projected to grow by 12.8% to 13% from 2022 to 2032, which is much faster than the average for all occupations [1].

- Estimates of total U.S. financial advisor jobs range from 240,000 to 370,000, with over 241,225 finance advisors currently employed in the United States [2].

- The mean hourly wage for personal financial advisors in the US is $ 66.22 [3].

5. Prove Your Financial Advisor Skills

Use this financial advisor resume skills list in your resume:

Financial Advisor Resume Skills

Hard Skills:

- Client education

- Generating financial reports

- Sales

- Equity analysis

- Financial planning

- Financial plan analysis

- Investing

- Research

- MS Excel

- Preparing and giving presentations

Soft Skills:

- People skills

- Accountability

- Confidence

- Dependability

- Honesty

- Listening

- Communication (verbal & written)

- Detail oriented

- Time planning

- Organization

Hey, wait!

Don’t drop all those professional skills in a resume for financial advisor jobs.

Target just a few shown in the job ad. Use both hard skills and soft skills.

Pro Tip: Do you lack financial advisor experience? Career changers and entry-level candidates should focus on skills that transfer. That just means showing achievements from other jobs.

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, our online resume builder will score your resume and our resume checker will tell you exactly how to make it better.

6. Add Other Sections to Your Financial Advisor Resume

Where’s your passion?

You need to show it stretches to your life outside of work.

To do that, add a couple “other” sections to your financial advisor resume.

Load them with more accomplishments. You can add:

- Financial advisor certifications

- Volunteering work

- Conferences

- Media mentions

- Publications

- Activities

- Sports

- Hobbies and side interests

- Awards & honors

- Kudos

- Languages you speak

Don’t overdo it, but definitely add at least a few non-work accomplishments that show your financial skills are worthy.

How to list certifications on a resume: Put your CFP right near your name, and in a special “Certifications” section under “education.” You can work it into each job title too.

Pro Tip: Volunteer work looks great on a financial planner resume. Just make sure you link it to the job skills by showing how you helped in a big way.

7. Attach a Cover Letter to Your Financial Advisor Resume

“Nobody reads financial advisor cover letters.”

Actually they do.

You must write a cover letter because most hiring managers love them. But don’t waste yours.

Instead:

- Break ground with the 3-paragraph covering letter format.

- Start your job application letter strong, by showing your biggest win or other eye-opening fact.

- Say something nice about the company.

- End your cover letter with an offer. Like, “I’d be happy to explain how I raised AUM by 22%.”

Pro Tip: Set a calendar reminder to follow up on your submission and financial advisor resume. If you don’t remind the busy hiring manager, your chance at getting hired will crash.

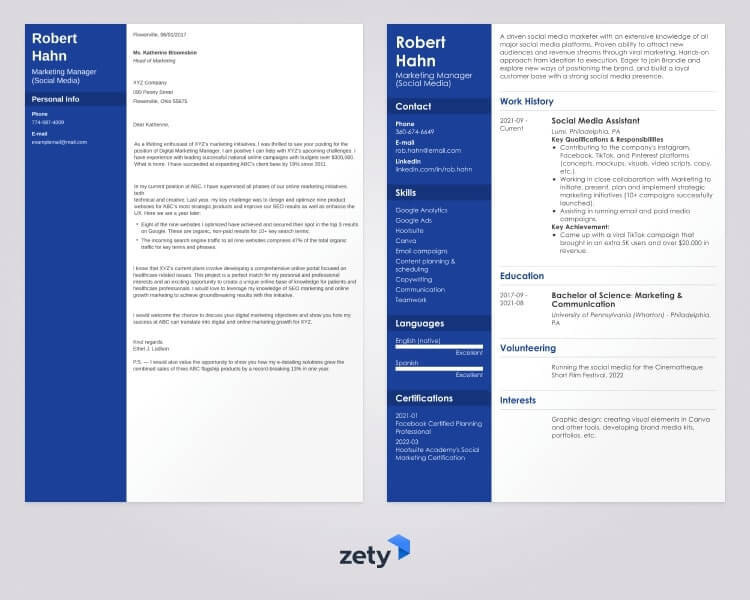

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

That’s it!

That’s how to write a resume for financial advisor positions.

There are some other guides that you might find interesting:

- Investment Banking Resume Sample

- Personal Banker Resume Sample

- Business Resume Sample

- Consultant Resume Sample

- Leasing Agent Resume Sample

- Leasing Consultant Resume Sample

- Private Equity Resume Sample

- Loan Processor Resume Sample

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.