You can spot a diamond in the rough and turn it into a priceless gem. But first, you need to get in the door at a top VC firm.

While your investment acumen may be unparalleled, your resume could probably use some work. Don’t worry—we’re here to help. When we’re done, your venture capital resume will shine brighter than the hottest new tech IPO.

This guide will show you:

- A venture capital resume example better than 9 out of 10 other resumes.

- How to write a venture capital resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a venture capital resume.

- How to describe your experience on a resume for a venture capitalist to get any job you want.

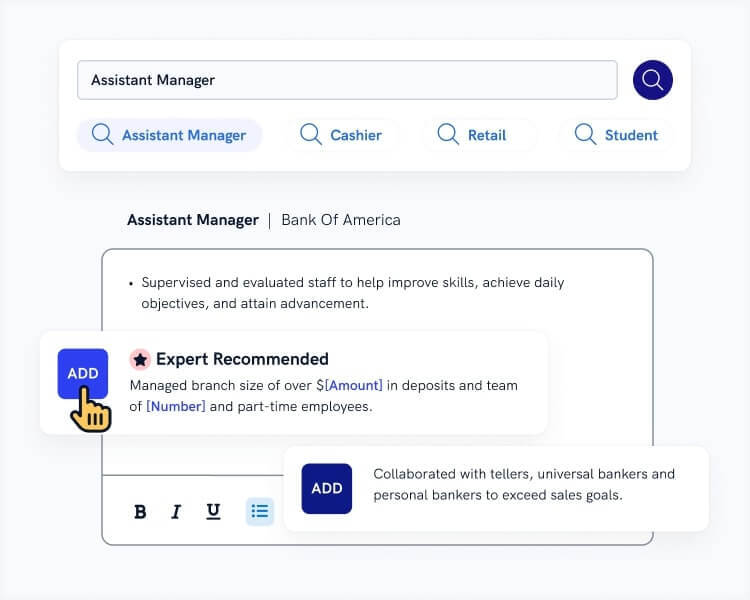

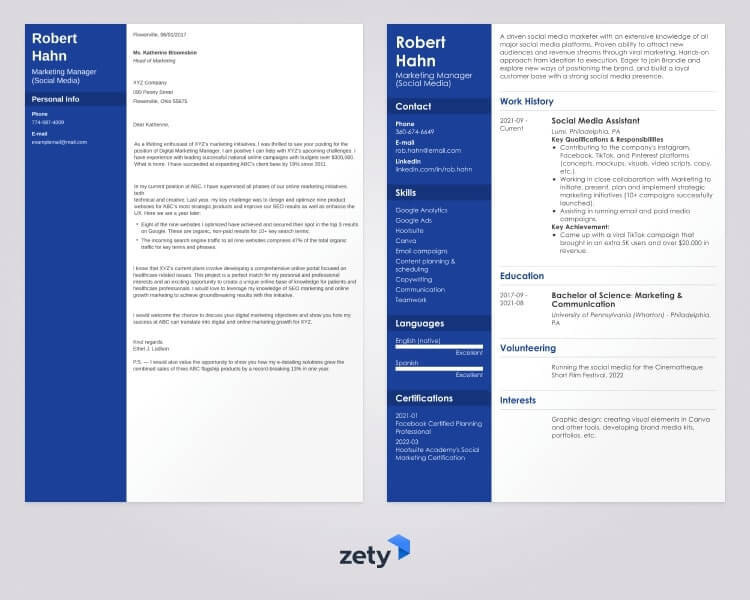

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

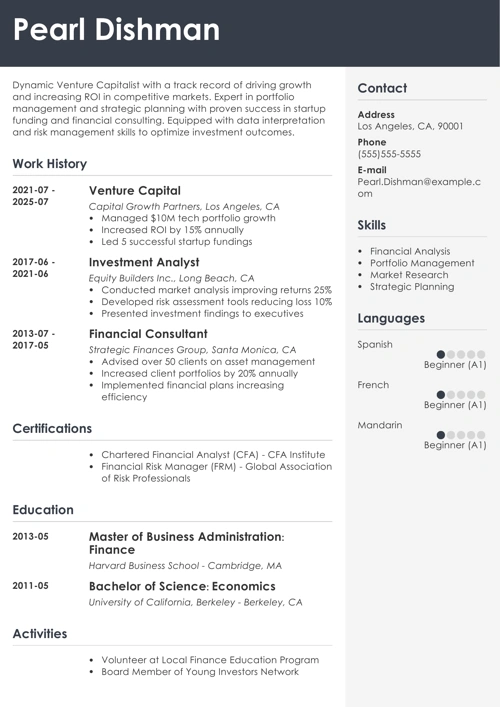

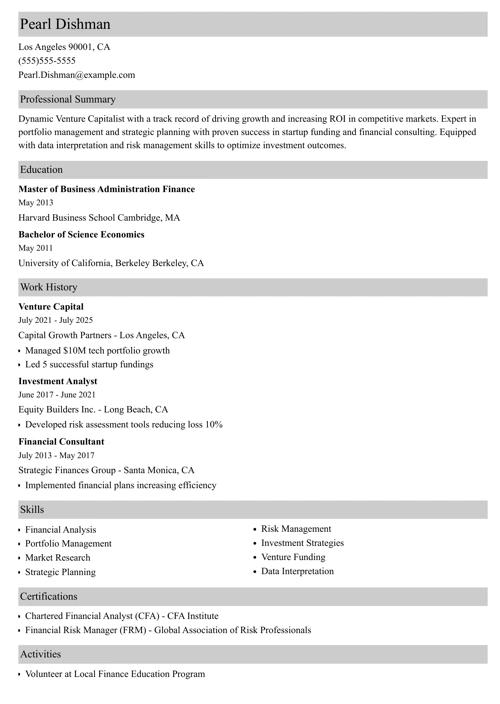

Sample resume made with our builder—See more resume examples here.

Want to invest time and energy into other ventures? See these guides instead:

- Banking Resume Examples

- Business Resume Examples

- Business Analyst Resume Examples

- Budget Analyst Resume Examples

- Chief Financial Officer Resume Examples

- Credit Analyst Resume Examples

- Finance Resume Examples

- Financial Advisor Resume Examples

- Financial Analyst Resume Examples

You may also check our bundle of 500+ resume examples for various professions.

Venture Capital Resume Example

Pearl Dishman

Venture Capitalist Investment Analyst

PDishman@sample.com

703-978-0183

Linkedin.com/in/pearldishman11

Summary

Passionate investor with 8+ years of startup and investment experience seeking to be a Venture Capital Investment Analyst at Fidelity Investments. Built an investment portfolio of over $500M and an average IRR of 32%. Negotiated Series A-C funding rounds totaling more than $350M. Looking to leverage my experience to help lead venture investments.

Work Experience

Venture Capital Investment Analyst

YAZAKI Corporation, Dallas, TX

April 2019–Present

- Investing in 15+ high-potential startups across AI, fintech, SaaS, and consumer sectors.

- Providing strategic guidance to portfolio companies, helping them refine business models, hire key talent, and expand partnerships.

- Analyzing 100+ investment opportunities annually, presenting recommendations to the investment committee.

- Generated 32% IRR on the fund’s venture investments to date.

Financial Analyst

BioSTL, St. Louis, MO

June 2015–March 2019

- Developed financial models in an up-and-coming biotech startup to evaluate 3 new product opportunities, estimating potential revenues of $2-$2.5 million and profit margins of 30-50%.

- Prepared and analyzed financial statements, reports, and projections to provide insights and recommendations to the management team.

- Identified risk areas and recommended strategies to improve financial performance and mitigate risk.

Education

2011–2015 BS, Accounting and Finance

University of California, Riverside

Skills

- Deal sourcing

- Financial modeling & analysis

- Working in dynamic environments

- Valuation

- Negotiation skills

- Time management

- Strategic planning

- Public speaking

- Relationship building

Achievements

- Funded 3 startups that achieved unicorn status and $1B+ valuations.

- Mentored over 50 early-stage founders through accelerator programs.

PersonalInterests

- Avid reader of tech news and trends.

- Passionate about helping entrepreneurs succeed and create economic opportunity.

You’ve seen our take, now it’s time to write your venture capital resume:

1. Format Your Venture Capital Resume Correctly

Venture capitalists invest in big ideas and identify opportunities through rigorous research that dives deep into potential gold mines. To land a good gig, your venture capital resume needs to show your Midas touch alongside a healthy dose of financial expertise and analytical thinking.

Here's how to craft yours:

- Go with a reverse chronological resume to present the most recent and relevant experience first.

- Use margins on your resume equal to 1" on all four sides for a polished, professional look.

- Stick to a simple yet reliable resume font like Helvetica at size 11 or 12.

- Limit the length of your resume to one page. Too much info is like an overstuffed suitcase—it won’t fly, and people will ask uncomfortable questions, such as “Why is this even here.”

- Upload your resume as a PDF to preserve the resume design you spent hours perfecting.

Read more: What Should My Resume Look Like?

2. Prepare a Venture Capital Resume Summary or Resume Objective

You’ve optimized the format of your resume for venture capital opportunities. Now it’s time to create a “hook” that catches the recruiter’s eye and lands your resume in the “Read Again” pile.

That's where the resume profile comes in. It’s a short, punchy introduction at the top that showcases your career in an attention-grabbing way. Writing one is critical. You have, on average, 7 seconds to impress before the recruiter moves on.

- If you’re an experienced venture capital investor, create a highlight reel in the form of a resume summary that mentions funds raised and obtained return percentages. Quantify your successes with numbers to stand out.

- For entry-level candidates, in a resume objective, focus on your knowledge background, any relevant internships, and transferable skills to demonstrate your ambition and potential.

Pro Tip: No hands-on VC experience yet? Take an entrepreneurship course, invest on your own to learn the market, start networking, and try setting yourself up with an internship at a VC company. Even small actions can set you apart.

3. Mention Your Experience on Your Venture Capitalist Resume

The biggest mistake when describing your work history is making it a dull list of generic bullet points. Instead of doing that, use impactful descriptions showcasing your accomplishments.

Don’t just say “managed budgets.” Say something like “streamlined budgeting processes, reducing expenses by 15% and freeing up $750K for strategic initiatives.” Numbers, concrete results, and a problem-solution format make your responsibilities come to life.

Other than that, when describing past job duties:

- Use the reverse chronological order and include your job title, company name, and dates of employment.

- Include between 3 and 6 bullet points for each position, keeping in mind that the old ones really don’t deserve more than 3.

- Forget irrelevant experience; that’s like relying on stock market data from the 1920s.

Pro Tip: Customize your resume’s work history for the specific job by highlighting the skills and experiences they’re looking for. Do that by analyzing the job posting like a balance sheet, identifying their line items of required experience, and then booking the relevant entries on your resume.

4. Describe Your Education on a Resume for Venture Capitalists

Every detail matters when raising millions of dollars depends on your resume standing out from a sea of term sheets. The education section is one of those details, and skipping it isn’t an option.

If you have 5 or more years of professional experience, you can make your education section concise:

- List only the school name, the program completed, and the graduation year.

- Focus the bulk of your resume on highlighting your relevant work experience, accomplishments, and skills.

On the other hand, a strong education section can help compensate for your lack of professional experience to show your potential.

If you're a fresh graduate, include your GPA if it's high, along with relevant coursework, extracurricular activities, and honors to demonstrate your qualifications.

Read more: Private Equity Resume Example + Full Guide

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, Zety’s resume builder will score your resume and our resume checker will tell you exactly how to make it better.

5. Show Off Your Venture Capital Skills on a Resume

Generic resumes don't impress in this business. Recruiters see thousands of them!

How do you fix this? Tailor your skills section for the role. Recruiters get bored reading the same dubious skills sections that tell them nothing. But when they see a skills section perfectly matched to their needs, they perk up.

Here's how to optimize your skill list:

- Make a master list of all your hard skills, soft skills, and technical skills.

- Refer back to the job description and look for those skills they consider highly desirable commodities.

- Only include the ones that match between both sets.

Need inspiration? Check the example below:

Sample Venture Capital Resume Skills

- Deal sourcing

- Investment analysis

- Financial modeling

- Valuation

- Risk assessment & management

- Strategic planning

- Negotiation skills

- Persuasion

- MS Office skills

- Data visualization tools (Tableau, Power BI or Google Data Studio)

- CRM systems

- Public speaking

- Presentation skills

- Relationship building

- Mentoring entrepreneurs

- Leadership skills

- Team building

- Innovation identification

- Market research

- Business development

- Fundraising

- Communication skills

- Problem-solving

- Critical thinking

- Creative thinking

- Adaptability skills

- Self-motivation

- Entrepreneurial mindset

Read more: What Skills to Put on a Resume

6. Include Additional Sections on Your Venture Capital Resume

A solid resume gets your foot in the door, but there’s always more you can do to stand out. The key is showing your personality. It sets you apart and makes you memorable.

Dig deep and find the values and interests that define you, then express them on your resume:

- Foreign language skills

- Hobbies and interests to not look like a corporate drone

- Certifications and licenses

- Awards and past successes

- Volunteer work

Read more: When Should You Show Freelance Work on Your Resume?

7. Attach a Cover Letter with Your Venture Capital Resume

A compelling cover letter can help you land your dream job as a VC. Around 50% of firms will skip candidates who don't include one.

To write an effective cover letter for VC jobs:

- Pick an appropriate cover letter format that won’t scare recruiters away faster than a horrible business pitch.

- Address the recruiter by name to show off that much-needed confidence.

- Demonstrate the traits of a successful VC in the cover letter body after opening your cover letter with a hook.

- Close the cover letter by expressing your passion for finding and funding the next unicorn.

- Keeping it short but persuasive will help ensure your letter stands out. Aim for 3 to 4 concise paragraphs.

Read more: What Should a Cover Letter Say?

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

Simple as that! A great venture capital resume!

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.