You've mastered the art of closing deals as a loan officer, but now it's time to close the deal on your dream job. Crafting a top-notch resume can feel like trying to calculate interest rates in your head, but don't worry!

Our guide is here to help you build a loan officer resume so impressive, hiring managers will be knocking down your door with job offers. Get ready to unlock the vault to your dream career!

This guide will show you:

- A loan officer resume example better than 9 out of 10 other resumes.

- How to write a loan officer resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a loan officer resume.

- How to put your loan officer job description for a resume to get any job you want.

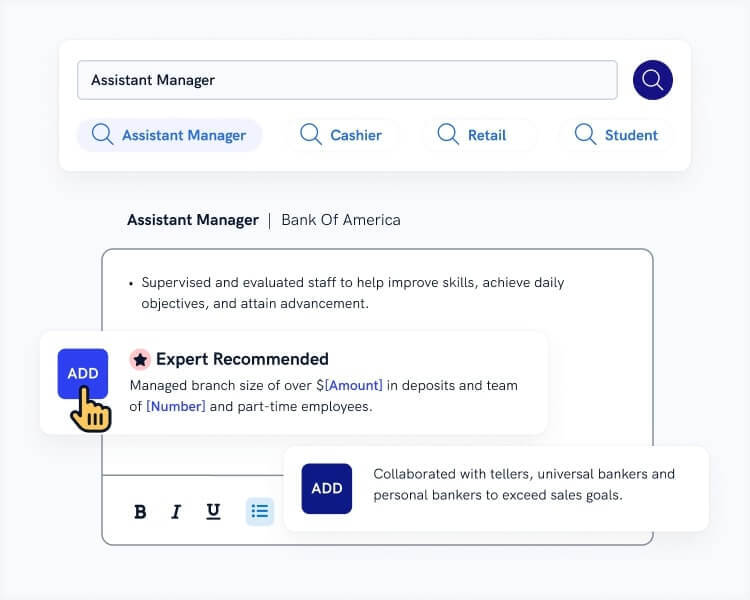

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. Explore our free resume templates and start building your resume today.

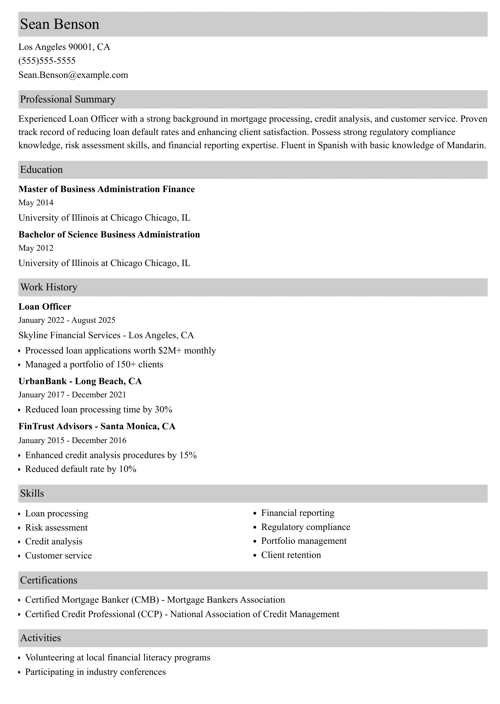

Sample resume made with our builder—See more resume examples here.

Looking for other finance and banking jobs? Check these guides:

- Loan Processor Resume

- Banking Resume

- Investment Banking Resume

- Personal Banker Resume

- Consultant Resume

- Collector Resume

- Financial Advisor Resume

- Insurance Sales Agent Resume

- Private Equity Resume

- Sample Resumes for 500+ Jobs

Let's have a look at an amazing loan officer resume sample:

Loan Officer Resume Example

Sean Benson

sean.benson@gmail.com

937-350-7857

Objective

Licensed and organized loan officer with 5+ years of experience in a fast-paced environment. Eager to help FinanceGuru realize its vision of becoming a market leader through creating the ultimate customer experience and developing cutting edge financial solutions. In previous roles managed a heavy pipeline of 50+ loans totaling ca. $25M, and regularly exceeded sales targets by 20-50%.

Work Experience

Mortgage Loan Officer

Mort & Gage Financial, Los Angeles, CA

2016–

- Sold and originated residential mortgages by customary and regular involvement in activities related to selling loans away from the office.

- Developed and maintained relationships with 50+ real estate agents, financial planners, individual borrowers, and builders.

- Obtained, verified, and compiled copies of loan applicants' credit histories, corporate financial statements, and other financial information.

- Met with applicants to obtain information for loan applications and to answer questions about the process.

- Analyzed potential loan markets to develop prospects for new loans.

Key achievements:

- Managed a loan pipeline averaging 50+ loans that totaled ca. $25M in financing.

- Awarded Employee of the Year in 2015.

Loan Officer

Best Loans, Santa Clara, CA

2013–2016

- Managed and grew a loan portfolio by regularly exceeding sales targets by 20-50%.

- Met benchmarks in multiple facets including profitability and credit quality.

- Promoted new business development. Actively extended the client portfolio by bringing in 100+ new clients.

- Cooperated with support staff and executive management.

Key achievement:

- Generated revenues in excess of $70K monthly.

Education

BA in Finance

UCLA, Los Angeles, CA

2013

Key Skills

- Closing procedures

- Conventional and government guidelines

- Customer service

- Federal lending regulations

- FHA guidelines

- MS Office

- Processing underwriting

- Self-motivation

- Teamwork

- VA guidelines

Certifications

- NMLS Certification

Languages

- Spanish—Advanced

- Chinese—Conversational

Interests

- Chinese pottery

- Travel (esp. the Far East)

Here’s how to write a loan officer resume that will make recruiters feel indebted to you for sending it:

1. Choose the Best Format for Your Loan Officer Resume

A loan officer helps people obtain loans (e.g. mortgages) based on their individual needs, goals, and financial situation. A loan officer resume must show the recruiter you know how to analyze your clients’ financials, and offer appropriate products. It should communicate this in a clear and well-structured manner:

- First off, learn how to make the best header for a resume. Just remember: putting a home address on your resume isn’t as vital as providing current contact details.

- Make sure the sections of your resume are easily identifiable and properly labeled.

- Your resume formatting matters. Chronological resumes usually work best as they put your latest experience and achievements in the spotlight.

- Use a good font for your resume. Opt for those readable to humans and the ATS alike.

- Don’t cram in too much on your resume. Leave white space to make it more readable.

- Submit your resume in a PDF format unless the job offer states otherwise.

2. Write a Loan Officer Resume Objective or Summary

The opening paragraph of your resume is called the professional profile.

This is where you present your professional highlights and introduce yourself to the recruiter. Think of this section in terms of your elevator pitch.

The resume profile can take the form of a resume summary or objective.

Here’s how to differentiate between the two:

A career summary focuses on your professional experience and achievements. It works best on a senior loan officer resume or if you have at least 2 years of relevant experience.

A career objective focuses on your skills and explains how they make you a perfect fit. Aresume objective looks great on an entry-level loan officer resume.

Whichever type of resume profile you use, it’s always a good idea to try and put some numbers (like $ or % for example) to demonstrate your real-life impact.

Pro Tip: Even though this section comes first on your loan officer resume, write it last. It will be much easier for you to pick out your resume highlights once the actual resume is ready.

3. Create the Perfect Loan Officer Resume Job Description

The truth is—

Your work experience on a resume matters most.

And it has to clearly tell the recruiter:

You’ll get the job done.

How to communicate this?

Tailor your resume to the job offer:

- Put your latest position first, and let the previous ones follow in chronologically descending order.

- In each entry list your business position titles, company location and name, as well as dates worked.

- Avoid writing paragraphs. Use 5–6 bullet points and pack them with accomplishments to prove your key skills.

- Start your bullets with resume action words, such as sold, developed, managed, etc.

- Focus on your relevant experience and try to quantify it as much as you can

Pro Tip: Double-check your resume for some of the most typical errors and read our guide on resume dos and don’ts.

4. Make Your Loan Officer Resume Education Section Sell

The exact education requirements are there in the job offer.

Here’s what you need to get your resume education section right:

- If you have more than 5 years of experience it’s enough to list your degree, school name, school location, and graduation year.

- If you have less experience, consider adding info on extracurricular activities, academic honors, as well as relevant coursework.

Your professional certifications and licenses should end up in a dedicated resume section to make them better visible.

Pro Tip: Add information on your GPA if it’s upwards of 3.5 and you graduated no more than 3 years ago.

5. Highlight Your Loan Officer Skills on a Resume

Let’s be honest—

It’s what you can do that makes you attractive to the employer.

The list below will help you identify your best loan officer skills.

Loan Officer Skills for a Resume

- Closing procedures

- Computer skills

- Conventional and government guidelines

- Courtesy

- Customer service

- Diplomacy

- Federal lending regulations

- FHA guidelines

- Maths skills

- MS Excel

- MS Office

- MS Outlook

- MS Word

- Processing underwriting

- Self-motivation

- Tact

- VA guidelines

- Analytical skills

- Teamwork skills

- Communication skills

- Critical thinking

- Decision making

- Interpersonal skills

- Leadership

- Problem solving

- Time management

Here’s how to choose the best skills for a loan officer resume:

- Make a master list that focuses on your entire skill set, including your soft skills, hard skills, and technical skills to put on resume.

- Revisit the job offer and find all the skills the employer lists by name.

- Find these exact skills on your list, and focus on them in your loans officer resume.

- Pick out up to 10 of your strongest skills and put them in a key skills section.

- Pepper your entire loan officer with skills. Make sure your resume profile and job description present your skills too.

One last tip: avoid listing the skills you only have a basic grasp of. This way you’ll avoid the so-called presenter’s paradox.

Based on an analysis of 11 million resumes created using our builder, we discovered that:

- Loan Officers usually list 11.2 skills on their resumes.

- The most common skills for Loan Officers are being customer service-focused, bottom line loanmaster loan servicing, financial transactions expertise, credit analysis, and client relations.

- Resumes for Loan Officers are, on average, 2.5 pages long.

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, our professional resume builder will score your resume and our ATS resume checker will tell you exactly how to make it better.

6. Add Other Sections to Your Loan Officer Resume

Show the recruiter you’re not only experienced and skilled but you have a personality:

Think about adding the following sections to your resume:

- Achievements and awards

- Volunteer experience on a resume

- Hobbies and interests

- Languages on a resume

7. Attach a Loan Officer Resume Cover Letter

Yes, they are.

At least that’s what more than 50% of the recruiters say.

Here’s how to write an impressive cover letter in a flash:

- Learn about the best cover letter formats.

- Make sure your cover letter first sentence sets the right tone.

- Show what value you can bring into the company.

- End your cover letter with a call to action.

And find out how long a cover letter should be.

Pro Tip: Follow up on your job application to increase your chances and show that you care.

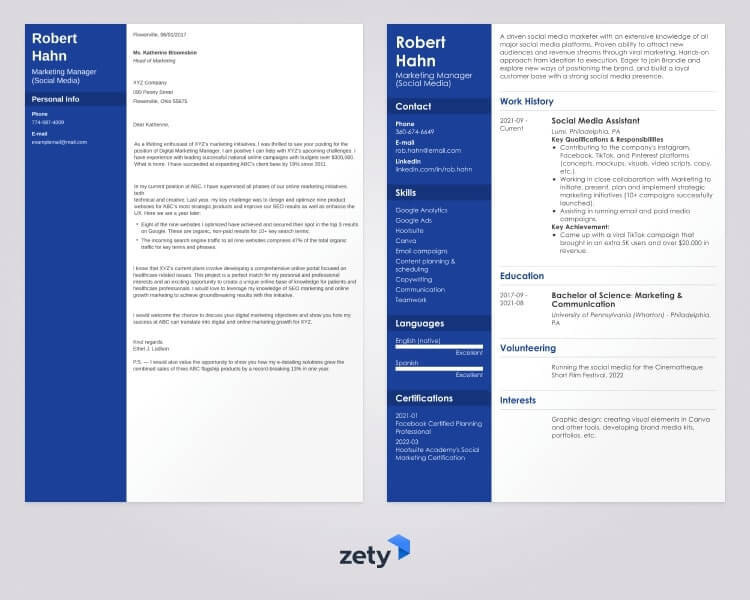

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

This is it!

This is how you make a job-winning resume for loan officer positions.

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.