Are you ready to sell yourself as effectively as you sell insurance policies? Crafting a stellar insurance agent resume is key to landing that dream job in the insurance industry. In this article, discover expert tips and resume examples that will help you highlight your unique skills and achievements, ensuring you stand out in a competitive job market.

This guide will show you:

- An insurance agent resume example that’s better than 9 out of 10 other resumes.

- How to write an insurance agent resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on an insurance agent resume.

- How to describe your experience on a resume for an insurance agent to get any job you want.

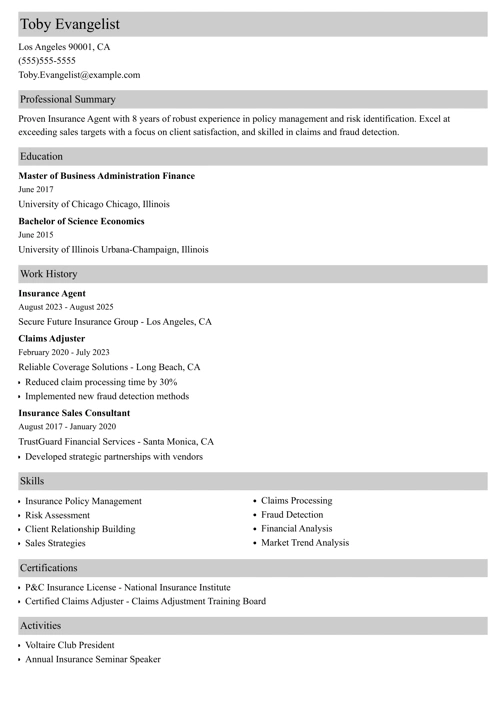

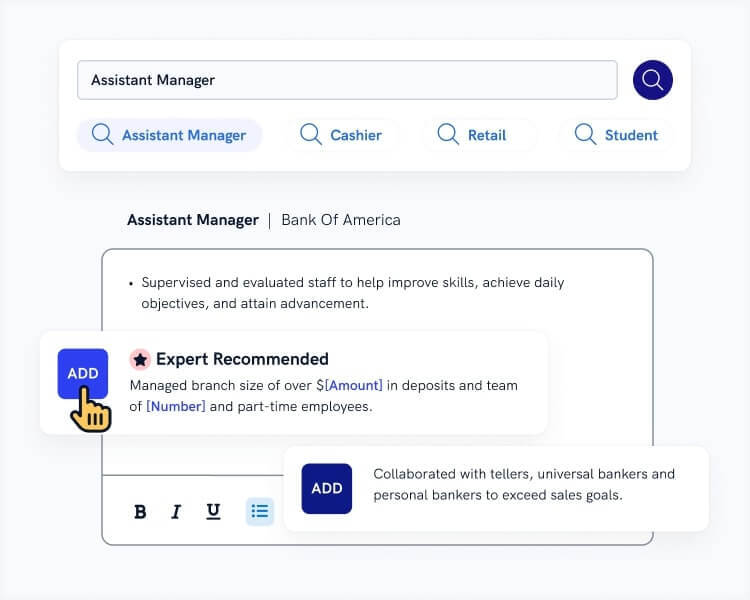

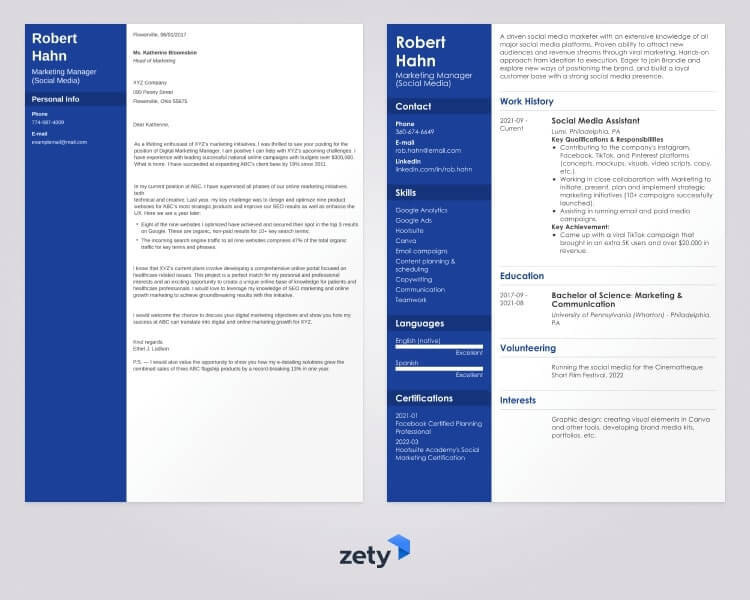

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

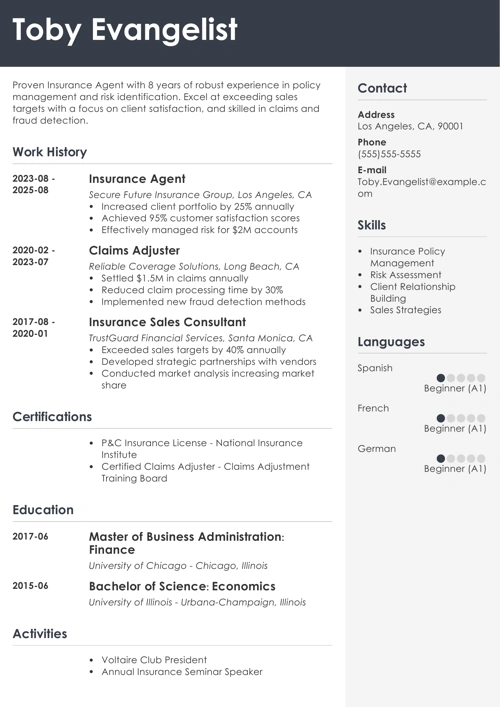

Sample resume made with our builder—See more resume examples here.

One of our users, Brittanya, had this to say:

Zety really helped me create the best resume possible. It pointed out how things could be better on my existing resume and suggested many things to be re-worded or removed.

Want to check more samples related to an insurance agent? Here you go:

- Sales Resume Sample & Guide

- Sales Associate Resume Sample & Guide

- Car Salesman Resume Sample & Guide

- Sales Manager Resume Sample & Guide

- Consultant Resume Sample & Guide

- Business Resume Sample & Guide

- Leasing Agent Resume Sample & Guide

- Loan Processor Resume Sample & Guide

- Travel Agent Resume Sample & Guide

- Resume Examples for Every Career

Insurance Agent Resume Sample

Toby Evangelist

Insurance Agent

toby.q.evangelista@gmail.com

linkedin.com/in/tobyqevangelista

Professional Summary

Efficient insurance agent with 8+ years of experience, skilled in upselling and qualifying leads. Seeking to increase sales and client satisfaction at Assurant Mutual. At Country Consolidated, maintained an upsell rate 17% higher than the department average. Converted cold inbound queries into sales with 85% success. Booked an average of $350,000 in new sales per year.

Work Experience

Insurance Agent

Country Consolidated, New York City, NY

March 2022–Present

- Through directed qualifying conversations, delivered 17% more upsells than the department average.

- Maintained an 85% sales rate on inbound queries through active listening, interpersonal skills, and product knowledge.

- Scored 99% in bi-annual product knowledge tests.

- Booked $350,000 in new sales annually thanks to following selling best practices and efficient use of time.

Insurance Sales Agent

Rural Coverage Group, New York City, NY

Dec 2017–Jan 2022

- Enrolled 200+ new clients in insurance plans.

- Built relationships with clients to surpass customer loyalty targets by 15%.

- Coached 3 other insurance agents in sales best practices.

Education

Bachelor’s Degree in Business

University of Wisconsin

May 2015–May 2017

- Excelled in sales-related classes.

- Vice president, student small business club.

Skills

- Sales,

- Upselling

- Cross-selling

- Outreach

- Writing reports

- Interpersonal Skills

- Communication

- Collaboration

- Leadership

Interests

- Volunteering in Habitat for Humanity

- Lead a weekly cycling group. Raised participation 25%.

Here’s how to write your own insurance agent resume:

1. Format Your Insurance Agent Resume Correctly

Capturing the attention of hiring managers amidst a sea of applicants is crucial for your insurance agent resume. What makes them pause and notice? A well-structured resume format can be your secret weapon for making a memorable impact.

To format your resume for insurance agent roles:

- Begin with a clear resume header. Include your name, phone number, email, LinkedIn profile, and any relevant online portfolio links. These are essential contact details for your resume.

- While your street address isn't necessary, mentioning your city can be beneficial, especially if it matches the job location.

- Opt for a reverse-chronological resume format, placing your most recent position at the top. This preferred resume layout aligns with what employers typically expect.

- Choose a professional font like Calibri or Arial, keeping the font size between 10 and 12 points.

- Save your document as “Your Name–Insurance Agent–Resume.pdf.” A PDF format ensures your resume layout remains intact, unlike Word documents.

- Keep your resume concise. For those new to the field, a single page suffices. More experienced candidates may opt for a two-page resume if necessary.

Read more: How long should my resume be?

2. Customize Your Insurance Agent Job Description

Why is it crucial to tailor your resume to a specific job? Generic work experience sections rarely catch the eye of hiring managers. They need to see how your past roles align with the job you're applying for to understand your potential.

Here's how to add relevant experience to your resume:

- Use the same job title mentioned in the job posting. ATS resumes perform best with precise business position titles.

- List the company's name and your employment dates, followed by 3–6 bullet points detailing your achievements (more for recent roles, fewer for older ones).

- Highlight your relevant skills through achievements that include metrics and KPIs. The best achievements to put on a resume are quantifiable.

- Start each point with resume action verbs such as negotiated, advised, and enhanced.

Insurance Agent Responsibilities for a Resume - Example

- Cultivate and maintain strong relationships with clients to understand their insurance needs and provide tailored solutions.

- Analyze clients' financial status and recommend suitable insurance policies.

- Explain complex insurance terms and conditions to clients, ensuring clear understanding.

- Develop marketing strategies to attract new clients and retain existing ones.

- Process policy renewals, amendments, and cancellations efficiently.

- Collaborate with underwriters to tailor insurance packages for clients.

- Conduct thorough assessments to ensure clients have adequate coverage.

Remember to use action verbs that convey your responsibilities and achievements effectively. Here are some action verbs for insurance agents:

Insurance Agent Resume Action Verbs - Example

- Negotiated

- Advised

- Enhanced

- Facilitated

- Implemented

- Consulted

- Assessed

- Secured

- Resolved

- Delivered

Did you know a past promotion can land the interview? Read more: How to Show a Promotion on a Resume (or Multiple Positions)

3. Make Your Education Section Count

Every resume features an education section, but there's more to it than listing your degree, school, and dates. Instead of stopping there, use this section to showcase additional skills and qualifications that can elevate your candidacy.

Check out these resume tips:

- The ideal placement for your degree is immediately following your work experience.

- For entry-level positions, include relevant coursework to demonstrate your capabilities.

- Even seasoned professionals can enhance their education section by mentioning fellowships, scholarships, or leadership roles.

- Debating whether to include your GPA? If it’s notably high, go ahead and list your GPA on your resume.

Read more: How to List Your Major and Minor on a Resume

Creating a resume with our builder is incredibly simple. Follow our step-by-step guide and use content from Certified Professional Resume Writers to have a resume ready in minutes.

When you’re done, Zety’s resume builder will score your resume and our resume checker will tell you exactly how to make it better.

4. Prove the Insurance Agent Skills the Company Wants

When listing skills on a resume, strategy matters. Simply jotting down a long list won’t cut it. Instead, focus on the specific skills emphasized in the job description to make your resume resonate with employers.

Here's how to effectively integrate insurance agent skills into your resume:

- Use resume keywords found in the job ad to tailor your skills section.

- Keep your list concise to ensure the most important skills stand out.

- Make sure these skills are mirrored in your job experience and educational achievements to boost your interview chances.

Insurance Agent Resume Skills

For insurance agents, combining technical and interpersonal abilities is crucial:

- Policy analysis

- Risk assessment

- Customer relationship management

- Sales and negotiation skills

- Financial planning

- Claims processing

- Interpersonal skills

- Verbal and written communication skills

- Leadership skills

- Organizational skills

- Problem-solving skills

- Time management skills

- Attention to detail

- Stress management

- Teamwork skills

- Computer skills

- Adaptability

Read more: What is the Difference Between Hard Skills and Soft Skills?

5. Add Other Sections to Your Insurance Agent Resume

The employment of insurance sales agents is growing faster than the average for all occuaptions. You need a resume that stands out. Adding additional sections to your insurance agent resume can help you with that.

Consider including these sections to highlight your qualifications:

- Include any relevant certifications such as a Chartered Life Underwriter (CLU) or Certified Insurance Counselor (CIC).

- If you've authored articles or papers, list them. Publications on a resume can establish your expertise in the field.

- Mention any professional organizations you belong to, like the National Association of Insurance Commissioners. Being part of associations shows your commitment to the industry.

- If you've participated in any volunteer work related to insurance, make sure to include it. Knowing where to put volunteer work on a resume can make a difference.

- Language skills can be an asset. Learn how to put language skills on a resume and include them if relevant to the job.

Read more: What Are the Correct Sections of a Resume?

6. Write an Insurance Agent Resume Summary or Resume Objective

In a world where hiring managers skim resumes quickly, a strong resume introduction can make all the difference. Capturing their attention with a concise summary that highlights your key achievements and skills is essential.

Crafting a resume profile is akin to delivering an elevator pitch about yourself. Though typically longer, an elevator pitch sets the stage for a compelling introduction. Here, a succinct, one-paragraph professional summary is ideal, particularly if you have at least a year of experience. It should include your job title, how you can contribute to the company, and notable achievements.

If you're new to the field and wondering how to write a resume with no experience, focus on academic achievements or personal projects. This approach forms an objective for a resume that effectively showcases your potential.

87% of hiring teams use LinkedIn to find new hires. See our guide: How to Upload a Resume to LinkedIn (Update & Add)

7. Write a Cover Letter for Your Insurance Agent Resume

In today's job market, cover letters are more important than ever. With many candidates applying to numerous positions, a personalized cover letter can demonstrate your genuine interest in a specific company.

To craft your resume cover letter:

- Use a professional structure, matching the header with your resume and concluding with a formal signoff.

- Format it concisely, aiming for 3–5 paragraphs and keeping it under one page.

- Start by introducing your job title and an engaging hook.

- In the body, highlight your top achievements relevant to the position.

- Conclude with a strong closing statement and express your desire for a discussion.

- Follow up on your application weekly for a month with a brief follow-up email and attach your resume and cover letter PDFs.

Read more: How to Write a Cover Letter for a Job

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.