You’re one of the few mortals who aren’t scared of taxes. In fact, you’re actually passionate about helping people and companies submit their tax reports. But being passionate isn’t always enough. To get a tax preparer job, you must sit down and do another universally dreaded thing: write a resume.

Don’t despair, though. We’ve put together a guide to help you write your tax preparer resume quickly and painlessly.

This guide will show you:

- A tax preparer resume example better than 9 out of 10 other resumes.

- How to write a tax preparer resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a tax preparer resume.

- How to describe your experience on a resume for a tax preparer to get any job you want.

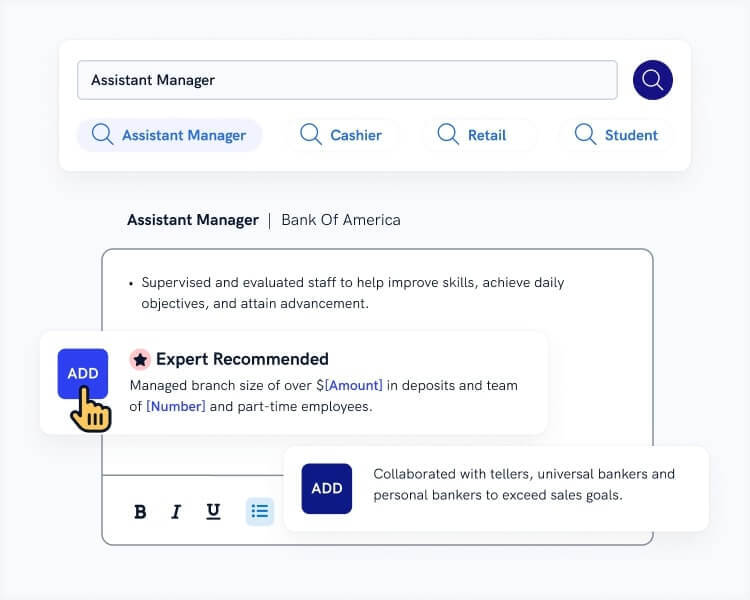

Want to save time and have your resume ready in 5 minutes? Try our AI resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

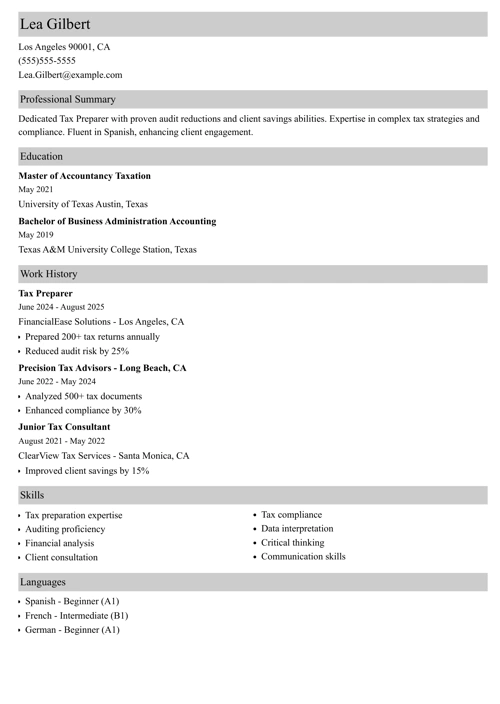

Sample resume made with our builder—See more resume samples here.

Tax Preparer Resume Sample

Lea Gilbert

Tax Preparer

lea.gilbert@email.us

555-875-2996

linkedin.com/in/leagilbert

Summary of Qualifications

Certified tax preparer with extensive knowledge of federal and state tax regulations and over 4 years of experience in preparing and evaluating tax returns. At Smiths Tax Services administered 120 tax reports for the tax season, maintaining 100% accuracy and ensuring the clients receive maximum benefits permitted by law. Helped one of the key clients to save $50,000 by identifying a recurring reports error. Seeking to leverage a tax deduction and compliance expertise at TaxationGuru.

Work Experience

Tax Preparer

Smiths Tax Services, Bozeman, MT

July 2016–December 2018

Key Qualifications & Responsibilities

- Prepared monthly and annual tax reports for small business and individual clients (around 120 reports in tax season).

- Analyzed tax law regulations to find potential deductions and recognize any deficiencies.

- Reviewed the company tax returns on a regular basis and prepared them for audits.

- Maintained positive relationships with clients, handled daily phone calls and emails.

- Run the company’s agenda of appointments and ensured all payments are done on time.

- Managed clients’ files and reports using the relevant software, including QuickBooks and TaxAct.

- Ensured confidentiality of client information.

Key Achievements

- In the recent tax season, administered 120 tax reports maintaining 100% accuracy and ensuring maximum client benefit as permitted by law.

Income Tax Preparer

CloudAcc Inc., Butte, MT

Jan 2014–June 2016

Key Qualifications & Responsibilities

- Reviewed clients income regarding potential deductions and credits.

- Assisted businesses and individual clients in preparing tax returns.

- Applied a federal state, and local codes to ensure tax compliance.

- Consulted clients on tax law and income statement documentation.

- Managed electronic tax records using QuickBooks.

Key Achievements

- Helped one of the key clients to save $50,000 by identifying a recurring reports error.

Education

BA, Business Administration and Accounting

Montana State University, Bozeman, MT

Completed: 2014

Relevant coursework: Commercial Tax Preparation, Corporate Taxation, General Accounting, Tax Planning and Research

Skills

- Attention to detail

- Focus on customer

- Tax deduction

- Tax compliance

- Tax returns

- Income tax regulations

- QuickBooks, TurboTax and TaxAct software

- Multi-tasking

- Analytical skills

- Problem-solving

- Time management

- Collaboration and teamwork

Certifications

- Registered as Chartered Tax Professional (CTP®), 2018

- Generally Accepted Accounting Principles (GAAP) Certificate

- Corporate Tax Returns 2019, Online Course

Looking for more inspiration on how to write finance resumes? Look at our dedicated guides:

- Accounts Receivable Resume

- Accounts Payable Resume

- Accounting Resume

- Accounting Clerk Resume

- Accounting Intern Resume

- Collector Resume

- Tax Accountant Resume

- Tax Intern Resume

- Loan Processor Resume

- Professional Resume Samples

Here’s how to write a professional tax preparer resume that will help you get this job!

1. Choose the Best Format for Your Tax Preparer Resume

What does your tax season T-shirt say?

Act. Count. Think.

Following simple rules helps with complex matters—

This is also true about writing a resume.

If you want to make your tax preparer resume clear as black and white use these simple resume formatting rules:

- Start with a professional header that includes your resume contact information.

- Create clear resume sections that are easy to follow.

- Use a chronological resume layout which puts your recent achievements up front.

- Pick good resume fonts. Classics always work best.

- Don’t overload your resume with too much information. Leave enough white space instead.

- If you’re not sure which one is better—PDF or Word resume, go for the PDF. Unless the employer asks for a different file format.

2. Write a Tax Preparer Resume Objective or Summary

Hiring managers are busy just as you are when taxes are due.

That’s why your resume usually gets only about a 6-second look-see.

No chance to get an extension.

So—

Act quickly and grab the recruiter’s attention right off the bat with a great professional profile.

It can be either a resume summary or resume objective:

Use a career summary if you have plenty of tax accounting experience. It’s your space to declare all the career wins and gains.

If you’ve just got your PTIN but have done little about it, use a career objective. It presents your skills and shows your motivation to do things right.

Pro Tip: Numbers don’t lie and you know it best. Add some $ or % to your tax preparer resume to show your achievements are quantifiable.

3. Create the Perfect Tax Preparer Job Description for a Resume

Your resume work experience section is the core of the spreadsheet.

Gather all records as it pays off!

But don’t just list every single thing you’ve done for a company or a client. List only the relevant duties and stay professional.

Here’s a checklist for a tax preparer job description:

- Tailor your resume to a job offer.

- Start with your latest or current job.

- List your job titles, company names, locations, and dates of work.

- Create a list of 6-7 experience bullet points for each position.

- Avoid “responsible for”. Instead, use a resume action verbs, such as prepared, resolved, monitored, utilized, ensured, etc.

Pro Tip: Looking for an entry-level tax prep position but don’t know how to get your feet wet? Find a freelance job online or do some volunteering first. These are both great for your tax preparer resume description.

4. Make Your Tax Preparer Resume Education Section Great

People trust you with the details of their financial life.

Now—

It's time to make the hiring manager trust you, too.

Even if some tax prep duties can be learned on the job, your resume education section is of great value to the hiring company.

Besides your IRS registration, add your educational history to your tax preparer resume. Here’s how:

- Candidates with rich professional experience can only list their degree, school name and location, and graduation year.

- Those who are less experienced should consider listing their GPA (if higher than 3.5), academic accomplishments and relevant coursework.

Pro Tip: Looking for opportunities to grow in the taxation sector or want to renew your tax professional credentials? Follow the activity of the organizations, such as The Accreditation Council for Accountancy and Taxation® and The National Association of Tax Professionals.

5. Highlight Your Tax Preparer Skills

A deduction ace is your office nickname and you’ve always had an eye for detail.

Time to itemize your skills.

Look at the list below and pick out the key tax preparer skills:

Tax Preparer Skills on a Resume

- Attention to Detail

- Knowledge of Current Tax Law

- Focus on Customer

- Computer Skills

- Familiarity with GAAP

- Tax Deduction

- Payroll Taxes

- Account Analysis

- Tax Compliance

- Tax Returns

- Income Tax Regulations

- Foreign Tax Regulations

- Strong Work Ethic

- Mathematical Skills

- Tax Software (ProSeries, TurboTax, TaxAct)

- Multi-Tasking

- Analytical Skills

- Critical Thinking

- Decision Making

- Problem-Solving

- Time Management

- Collaboration skills

Pro Tip: What’s the best way to select relevant skills for your resume? Create a master list of all your job skills (soft skills, hard skills, and technical skills). Then reread the job offer and pick only these skills that are sought-after.

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, our AI resume builder will score your resume and our resume checker will show you exactly how to improve it.

6. Add Other Sections to Your Tax Preparer Resume

All the above sections—these are more than necessary.

But is there any other chance to impress the hiring manager?

Consider adding the following sections to your tax preparer resume:

- Activities

- Language skills

- Achievements and awards

- Professional certification

- Volunteer experience

- Hobbies and interests

- Professional associations

Pro Tip: Tax preparers who got state licensure may call themselves CPAs. Be careful when listing your CPA credentials on a resume or a LinkedIn profile and check if your licence is still valid. The license status requirements may vary from state to state.

7. Attach a Tax Preparer Resume Cover Letter

Do you need a cover letter for your tax preparer resume?

You do. More than 50% of hiring managers still expect to get one.

Follow the tips below to write your tax preparer cover letter and win that interview:

- Format a cover letter correctly. Use clear headings and paragraphs.

- Set the right tone with a catchy cover letter opening sentence.

- Say what you can offer to the employer.

- Make a call to action when ending a cover letter.

Pro Tip: Should you follow up on your job application? Positive. A follow-up email will boost your chances of getting this dream tax prep job.

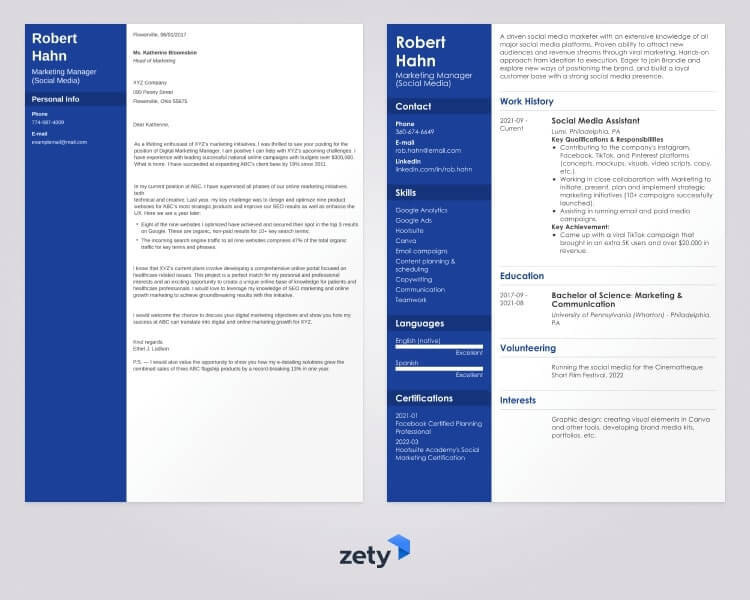

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

That’s it!

You just saw a job-winning tax preparer resume sample and you’re ready to write your own one.

We've got some more resume guides you might find interesting:

- Insurance Sales Agent Resume

- Bank Teller Resume

- Bookkeeper Resume

- Budget Analyst Resume

- Business Resume

- Business Analyst Resume

- Consultant Resume

- Financial Analyst Resume

- Data Analyst Resume

- Data Entry Resume

- Payroll Resume

- Personal Banker Resume

- Staff Accountant Resume

- Private Equity Resume

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.

![Tax Preparer Resume Sample & Writing Guide [20+ Tips]](https://cdn-images.zety.com/pages/tax-preparer-resume-example-ztus-cta-02.webp)