The banking sector is still one of the least trusted in the world. Kind of for a good reason, given all the MBS’s and other semi-fraudulent instruments of the past.

But we can fix that, brick by brick. Educated professionals constitute one of those.

To get into the field and start building up both your reputation and your career, your mortgage underwriter resume needs to be rock solid. Literally too good to fail!

This guide will show you:

- A mortgage underwriter resume example better than 9 out of 10 other resumes.

- How to write a mortgage underwriter resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a mortgage underwriter resume.

- How to describe your experience on a resume for a mortgage underwriter to get any job you want.

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

Sample resume made with our builder—See more resume examples here.

Take a look at these related guides as well:

- Banking Resume Examples

- Finance Resume Examples

- Financial Advisor Resume Examples

- Financial Controller Resume Examples

- Accounting Resume Examples

- Loan Officer Resume Examples

- Budget Analyst Resume Examples

- Loan Processor Resume Examples

- Bank Teller Resume Examples

- Best Resume Examples & Guides for All Jobs

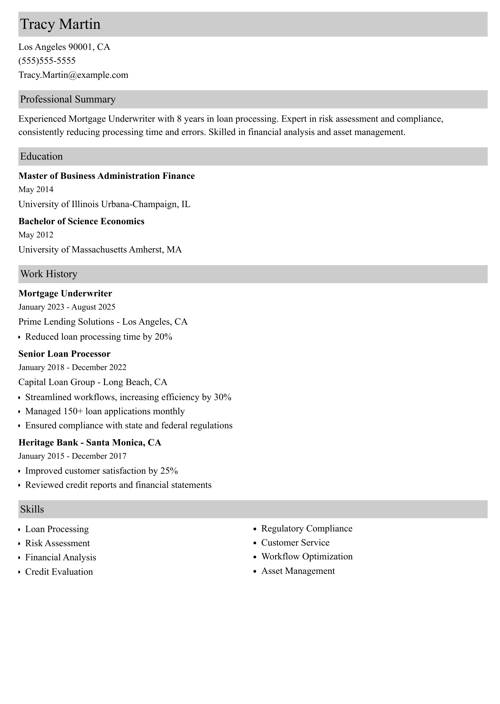

Mortgage Underwriter Resume Example

Tracy Martin

Mortgage Underwriter

978-792-8427

tracy.martin@zetymail.com

linkedin.com/in/7tracy.martin

Summary

Diligent mortgage underwriter with 8+ years of industry experience, including 2 years at Navy Federal Credit Union. Received “Employee of the Quarter” award in 2019 and 2021. Approved roughly 50 loans per month while keeping error rate under 4%.

Work Experience

Mortgage Underwriter

Navy Federal Credit Union, Pensacola, FL

March 2019–present

- Reviewed loans for possible internal/external fraud and maintained error rate under 4%.

- Performed constant benchmarking and trend analysis to improve process efficiency by 15%.

- Generated $200K in monthly revenue.

- Elevated service performance and increased quality of member experience, in turn raising satisfaction quota by 0.2 points in comparison to colleagues.

Loan Processor

CitiBank, Davie, FL

April 2014–June 2017

- Created document checklists for loan modification processes.

- Optimized business process flow, increasing successful loan applications by 70% over a period of 1.5 years.

- Processed ~25 refinance loan requests daily.

Education

High School Diploma

Lindley High School, Greensboro, North Carolina

2006–2010

- GPA: 3.9

- Relevant Coursework: Home Economics, Information Technology

- Member of the DECA Marketing and Business student club

Key Skills

- Loan risk & fraud analysis

- Customer service

- TMO/Diamond software

- MS Office

- Analytical skills

- Attention to detail

- Decision-making skills

- Communication skills

- Problem-solving

Certifications

- FHA Direct Endorsement Authority Training, 2017

Additional Activities

- Part-time volunteer financial analyst in local homeless aid organization

Now, check out these seven steps to a supreme mortgage underwriter resume:

1. Use the Best Mortgage Underwriter Resume Formatting Template

A mortgage underwriter’s chief task is to pass judgment on a borrower’s financial situation to determine whether they can be lent the money. Critically, a mortgage underwriter resume has to show risk assessment, examining documentation, and attention to detail as major skills.

First thing the hiring manager will want to appraise? Your resume structure:

- Naturally, include your contact information in your resume.

- These days, the standard is writing using the reverse-chronological resume format, due to its unbeatable method of showcasing your achievements clearly and concisely.

- Utilize white space and headings to make your resume easy to read.

- Choose a professional resume font for an even better impression.

- The margins around your resume need to be set to 1 inch.

- Make sure to read up on the details of what to do if you’re writing a resume without experience.

How long should a resume be? One page, in the vast majority of cases. A two-page resume is only a good idea if you have 10+ years of experience and lots of relevant accomplishments to share.

Read more: Best Resume Types for Success

2. Write a Mortgage Underwriter Resume Objective or Summary

A client’s suspicious credit history sets off alarms for you, doesn’t it?

Well, recruiters look at overly lengthy resumes the same way. When things don’t add up, applications get deleted. Nobody wants to get tangled up in a bad investment.

How do you avoid that unfortunate fate?

With a resume profile.

A resume objective or a resume summary, to be precise.

Write a resume summary if you've got a few years of experience as a mortgage underwriter. It will show the juiciest parts of your history in real estate in an easily digestible form.

Otherwise, a resume objective will serve you well if you threw your graduation cap in the air only recently, or are new to the profession in general.

If you get stuck, don’t worry—just write your resume profile at the end, once you’ve finished the other sections. It’ll be much easier.

Read more: How to Start a Resume: Strategies and Examples

3. Describe Your Experience as a Mortgage Underwriter

If you’re gunning for that job at Fannie Mae or Freddie Mac interview you’re dreaming of, your resume experience section needs to be more appealing than a no-risk high-return. Get it right with a stellar mortgage underwriter job description:

- List the last job first, and the first job last.

- Each entry needs your job title, company name, and years of employment.

- Now, depending on when you worked there, you need to add either up to 6 (newest) or 3 (oldest jobs) bullet points that describe relevant experience and quantifiable achievements. You don’t need a full list of mortgage underwriter duties: the recruiter already knows what the role involves. Focus on things you’ve achieved in the role.

- Use action verbs at the beginning of each of your bullet points, and include numbers where possible. They add context and impact.

Read more: How Far Back Should a Resume Go

4. Make the Most out of Your Mortgage Underwriter Resume Education Section

A strong resume education section is a must if you want to start handing out those home loans and—more importantly—getting paid for it.

If you’ve been underwriting mortgages for a while, write the name and location of your school, graduation year, and the highest degree you obtained.

Conversely, with less than 5 years of real experience in the field, you’ll want to up your credit score with the employer first. This means adding more details to your resume like extracurricular activities,relevant coursework, or diploma honors.

Doing so highlights your ability to learn and excel no matter your experience. Mortgages are complicated things with their various clauses, so the employer needs to know you’ve got your wits about you.

Now, let’s talk about your skills.

Pro tip: Great, you’ve written both the experience section and the education section. Try to compare them and see which one is more impressive. Entry-level mortgage underwriters should typically list education first, as their experience may still be lacking.

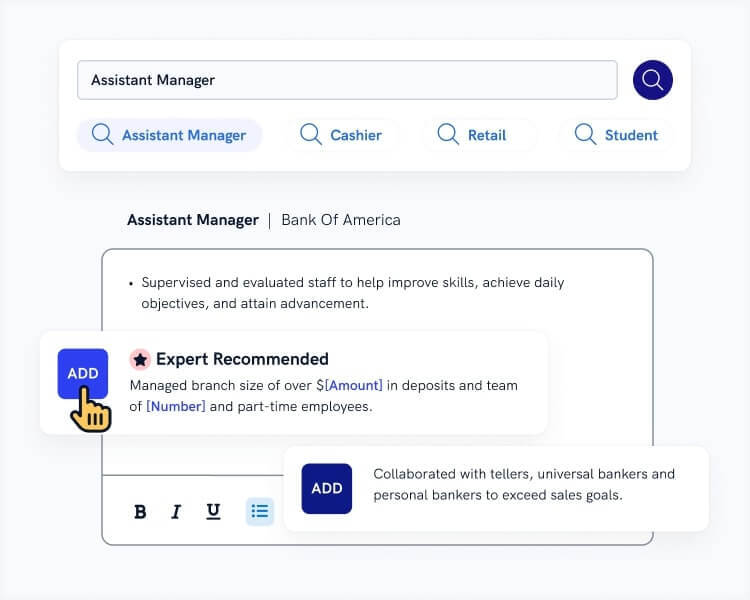

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, our professional resume builder will score your resume and our ATS resume checker will tell you exactly how to make it better.

5. Tailor the Skills Section to Their Expectations

Here’s a sample list of skills for a perfect mortgage underwriter resume:

Mortgage Underwriter Resume Skills

- Loan Risk Analysis

- VA/FHA/USDA/RHS Loans

- Reviewing & Verifying Documentation

- Automated Underwriting Software (Quicken Loans, Desktop Underwriter)

- Preparing Reports

- FHA Laws

- Data Analysis

- Assessing Findings

- Decision-Making Skills

- Ensuring Regulation Compliance

- Documenting Mortgage Process

- Ability to Prioritize

- Commitment to Ethics

- Honesty

- Organizational Skills

- Time Management

- Detail-Oriented

- MS Office

But, if it wasn’t clear yet, the devil is in the details and in the fine print—as always.

If the above list of skills isn’t you, don’t worry. Submitting all of that would have set off fraud alarms anyway.

The better way of going about this is tailoring the skills section to the employer’s needs, like so:

- Prepare a table or list with all of your soft skills,hard skills and technical skills. They all count when creating a resume, and you need to show a good mix.

- Let the job posting guide you. They phrased things a certain way for a reason, meaning you should be able to tell what skills they value.

- If you find any matches between those and the list of skills you just prepared, put up to 10 of them onto your resume.

One other thing: the soft limit of skills is 10, yes, but if you design the descriptions of your job duties cleverly, you can sneak even more skills in there!

Read more: What Skills to Put on a Resume

6. Include Extra Sections on Your Mortgage Underwriter Resume

According to the BLS, mortgage underwriters and other money-lending professions are set to stagnate over the next decade.

That does not bode well.

If you let your resume stagnate alongside the rest of them, you’re not going to have a good time, because you’ll likely be out of a job.

The fix?

Additional resume sections!

They breathe some extra life into your application and they allow the recruiter to see your passion for the job in general.

Here are a few good additions to any mortgage underwriter resume:

- Hobbies and interests

- Certifications and licenses

- Volunteer work

- Organizations memberships

- Awards and achievements

- Foreign languages

- Passion projects

Read more: Expert Advice on Resume Dos and Don’ts

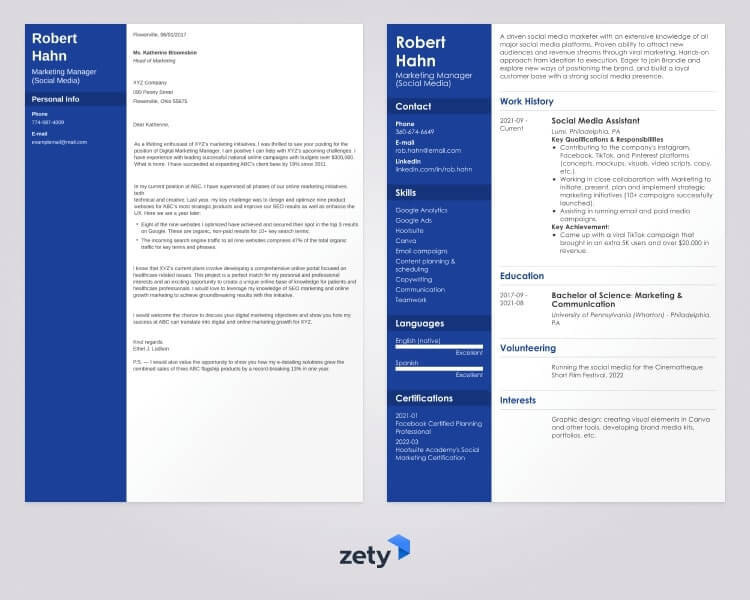

7. Write a Cover Letter to Go with Your Mortgage Underwriter Resume

So, what’s the scuttlebutt on cover letters nowadays? Are cover letters still a thing people actually write and submit?

Short answer: those that get hired do.

But a cover letter is only as good as the intent behind it. Write a poor one, and you’ll be worse off than if you never sent it.

Instead, go about it the proper way:

First, know how to format a cover letter. It needs to have the same sleek, professional look as your mortgage underwriter resume.

Second, address the cover letter directly to the recruiter and hook them in the first sentence in a bold cover letter opening statement.

Third, sell yourself in your cover letter. Prove the company could use someone of your skill set, and demonstrate that value using more of your past accomplishments.

Lastly, include a call to action, name the cover letter professionally, and sign off respectfully.

And don’t forget that a cover letter shouldn’t be too long. One page with 3–4 paragraphs is definitely enough.

Read more: How to Write a Cover Letter: In-Depth Guide + Examples

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines. We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.